Executive Briefing E-Books

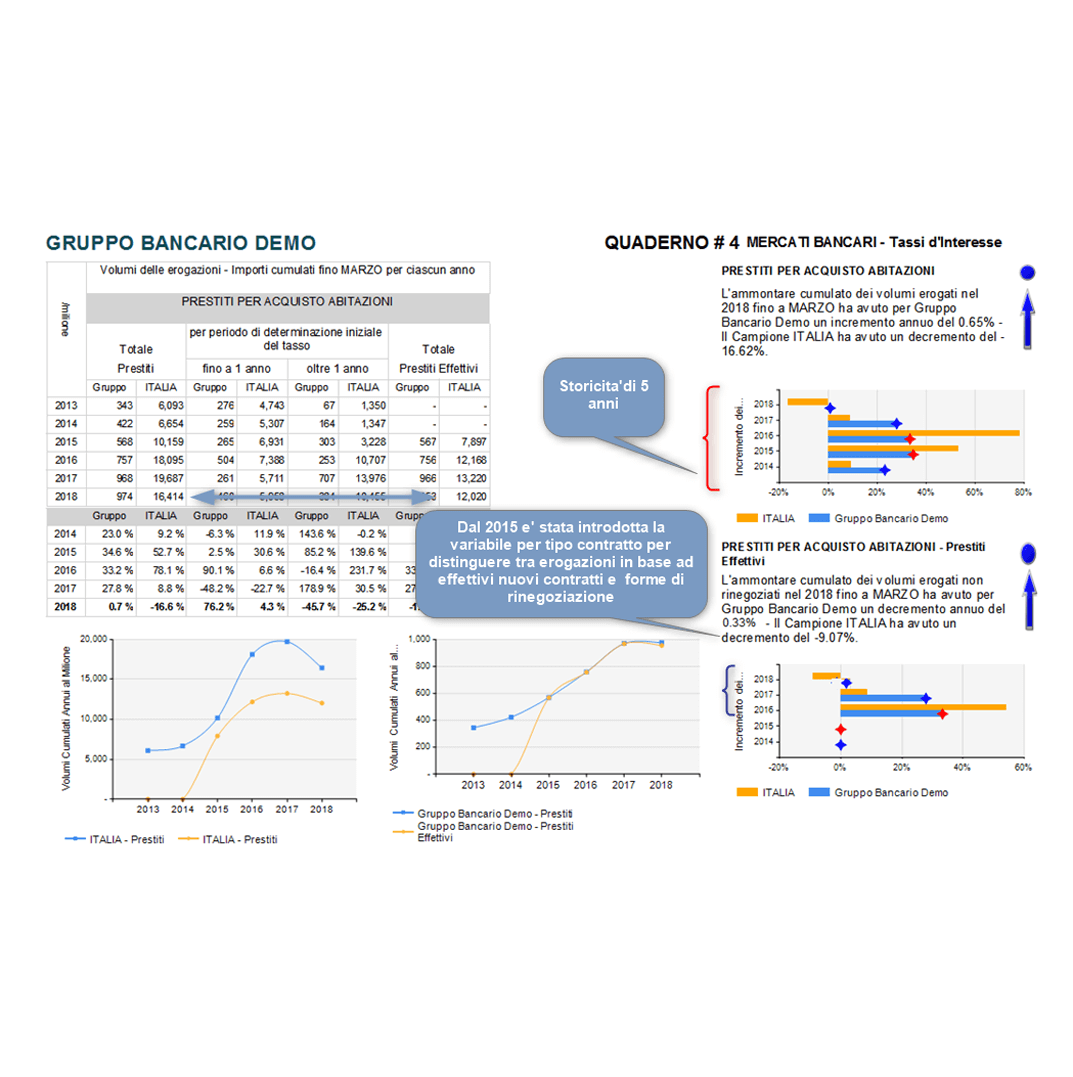

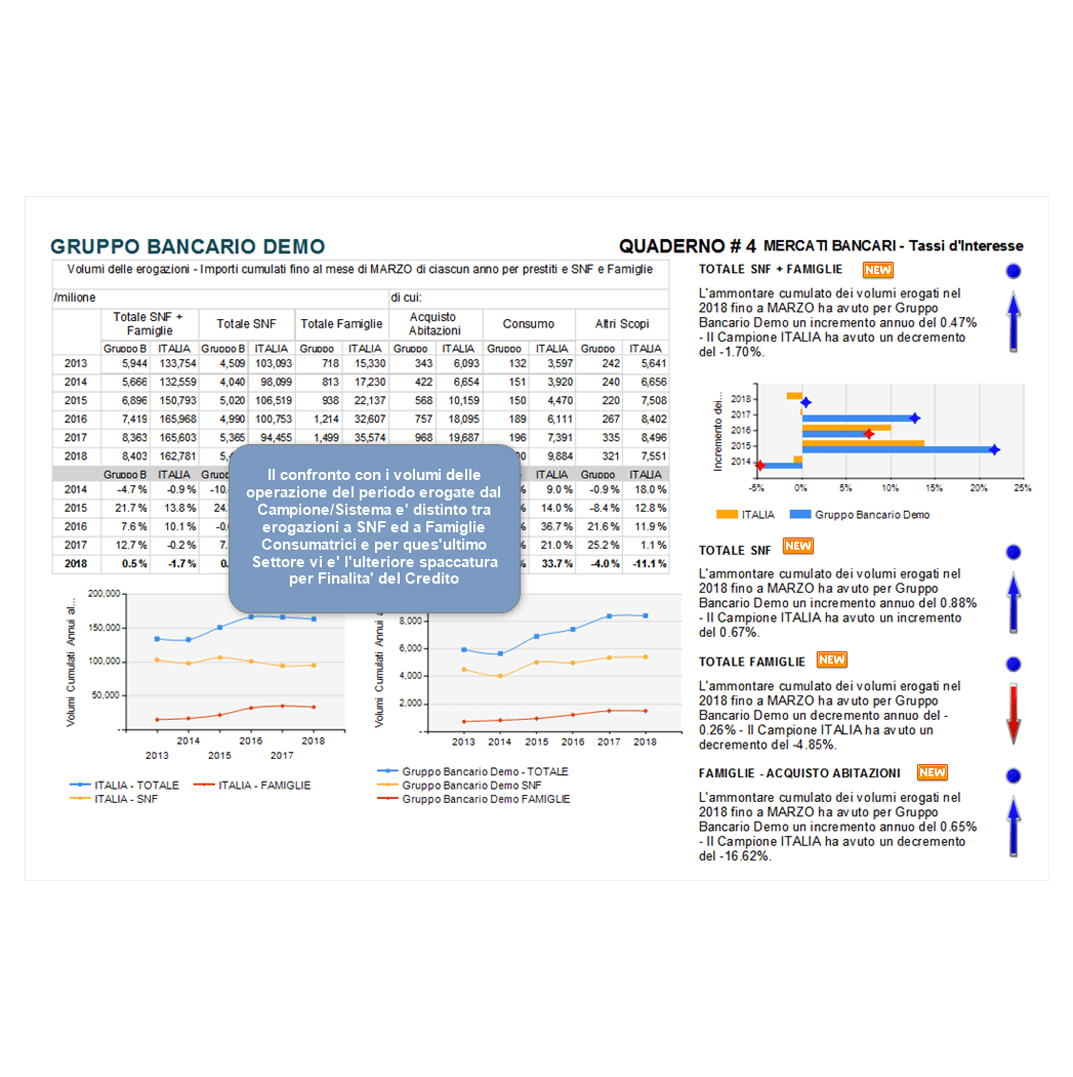

E-Books track data and create near-time reports on new business interest rates, loan and deposit activity, as well as average monthly interest rates of outstanding activity segmented by non-financial corporations (NFCs) and household-consumer markets. The Bank’s/BHC’s are compared to the average data of a peer group of Banks/BHCs reporting monthly to the European Central Bank. E-books:

- ● deliver regular standardized reports on European banking statistics within the core banking industry

- ● offer monthly reviews of the Bank’s/BHC’s performance as well as peer-comparative reports within 40 days of month end

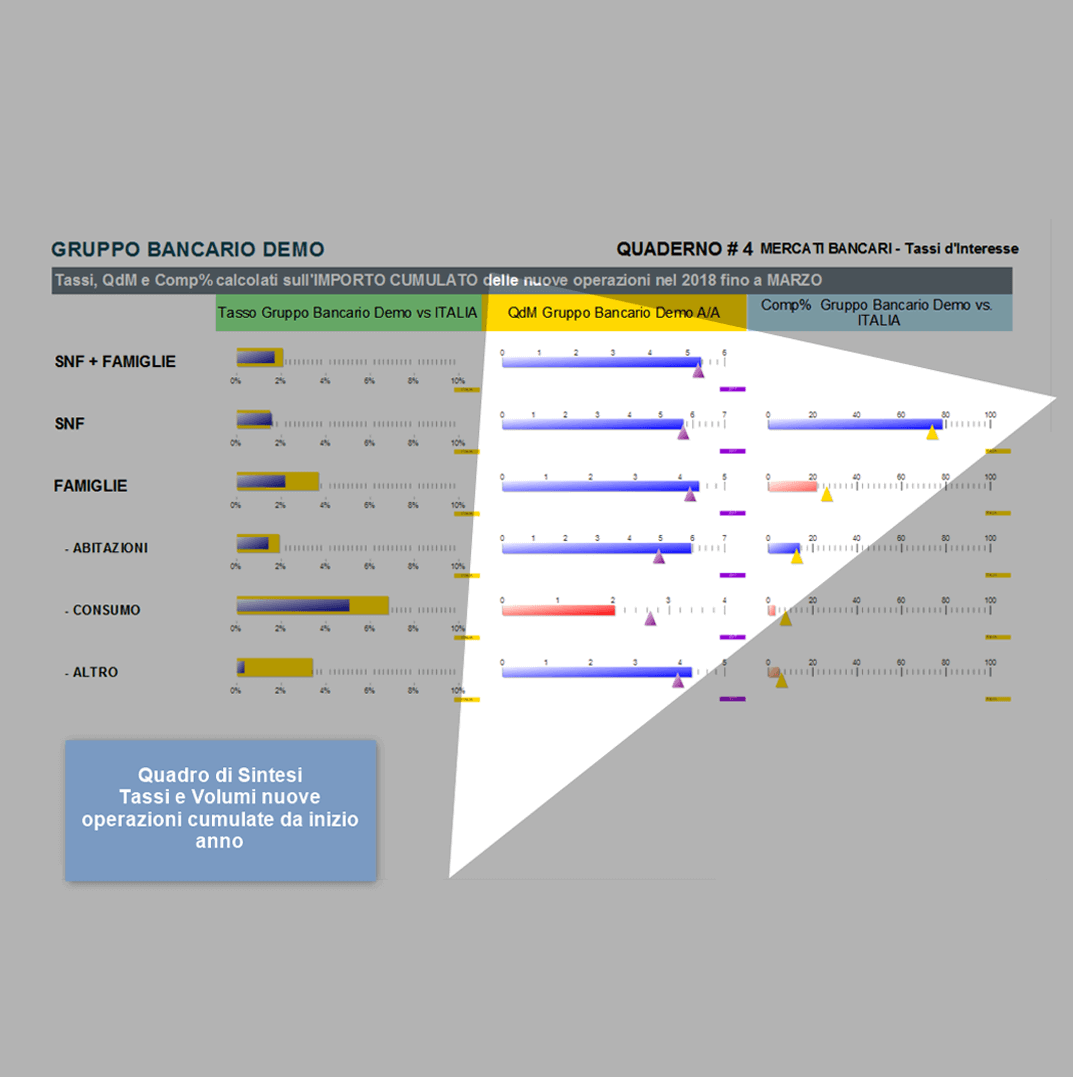

- ● use strong visuals to highlight key market analytics

- ● provide at-a-glance statistical analysis of the Bank’s/BHC’s performance data including key Credit Risk advance/decline indicators

Content

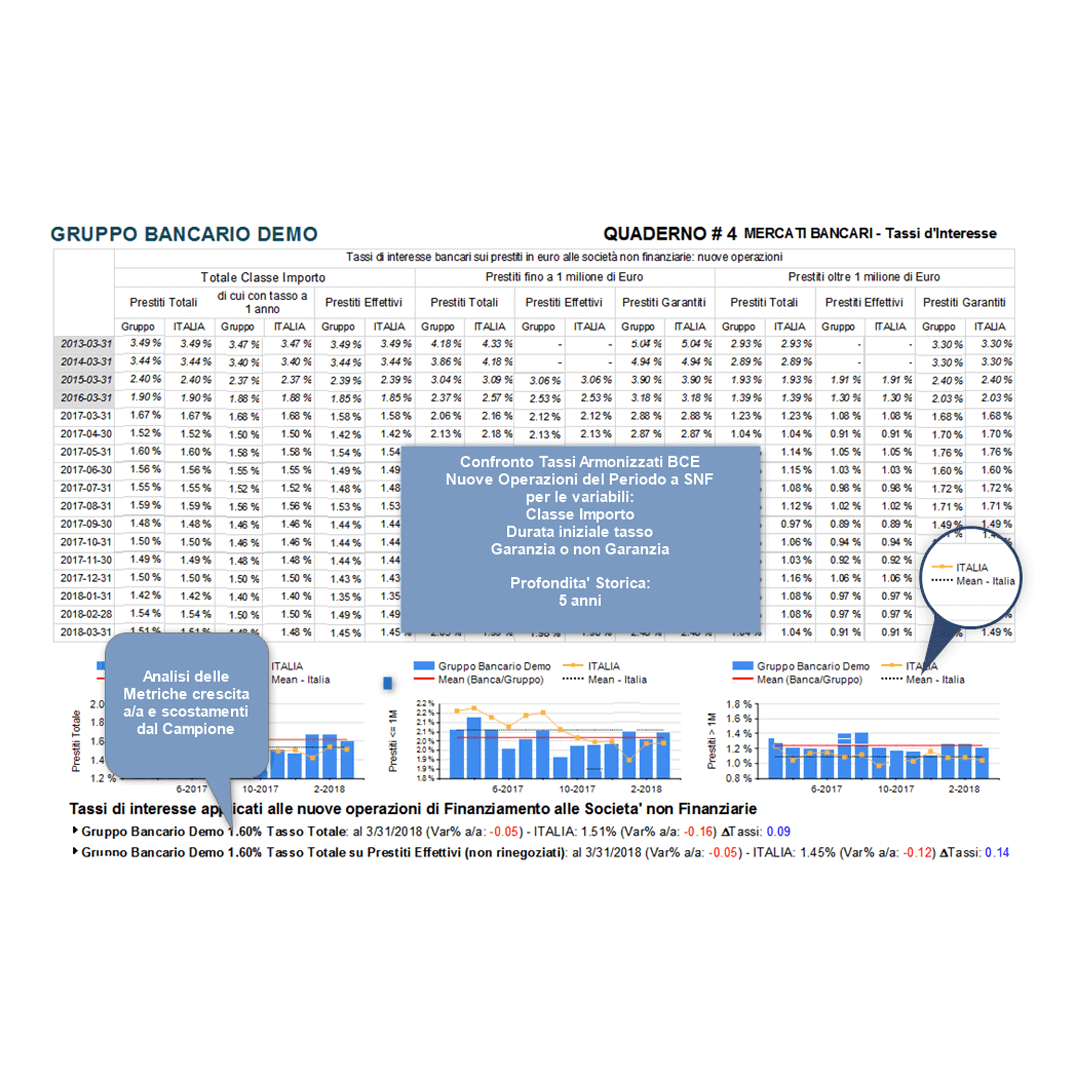

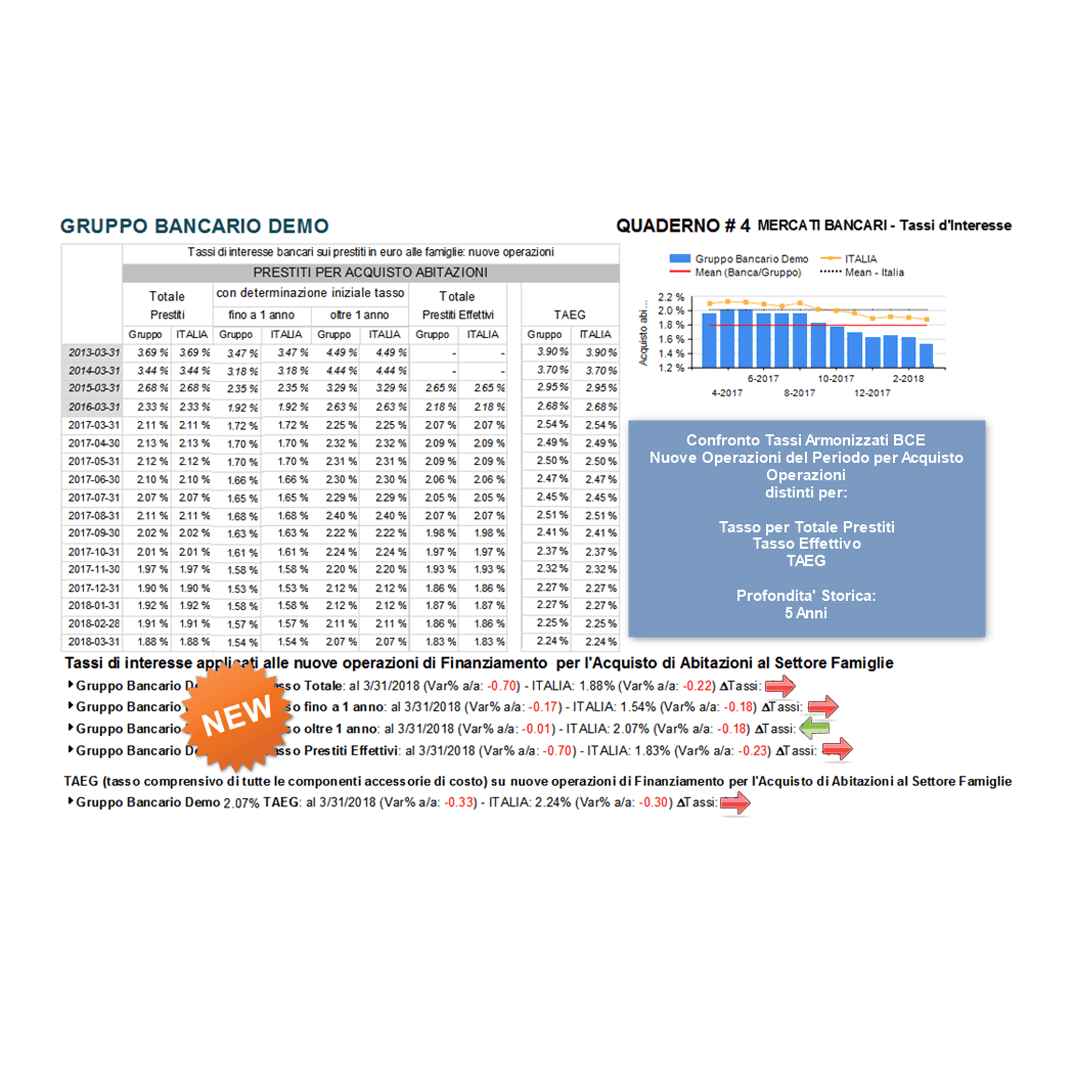

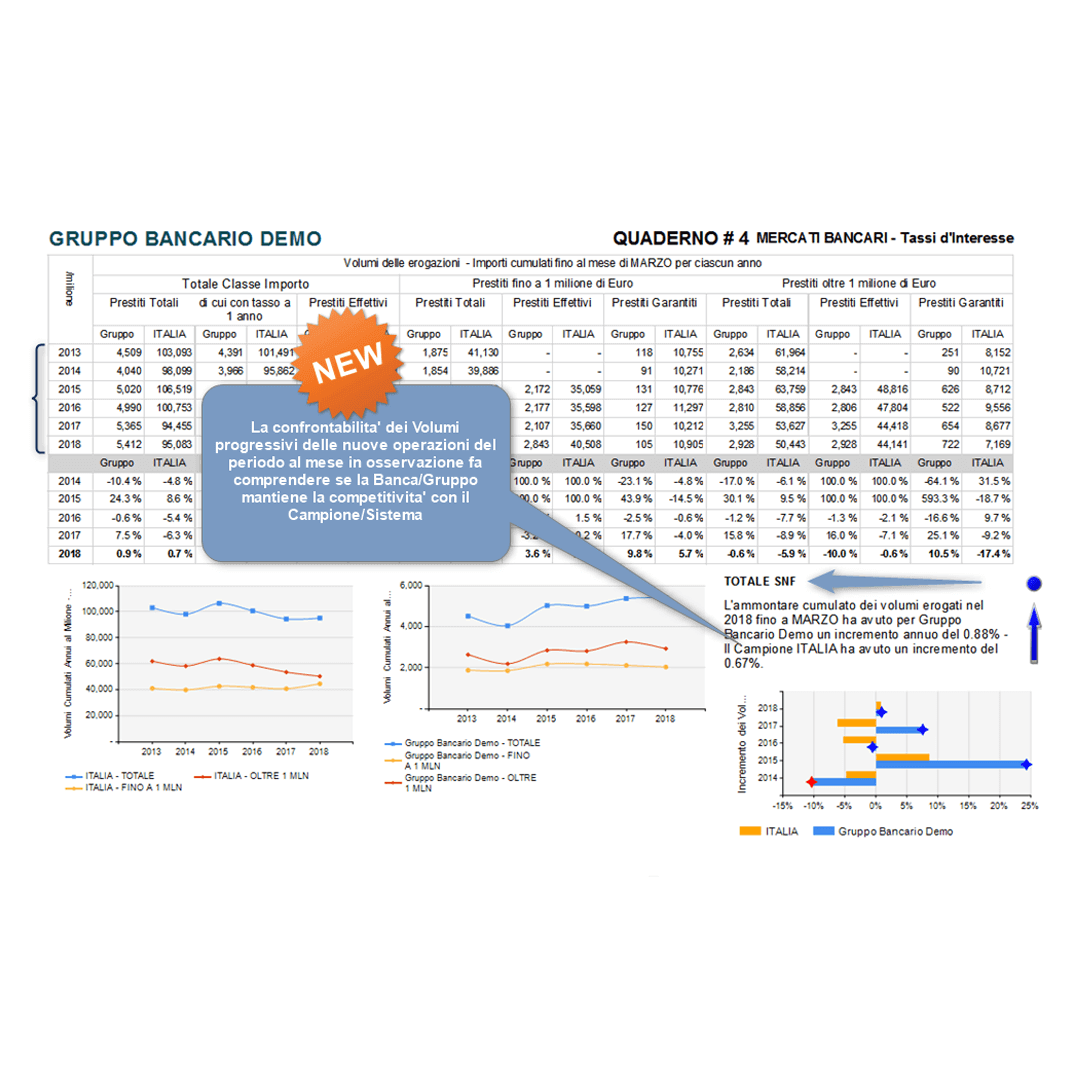

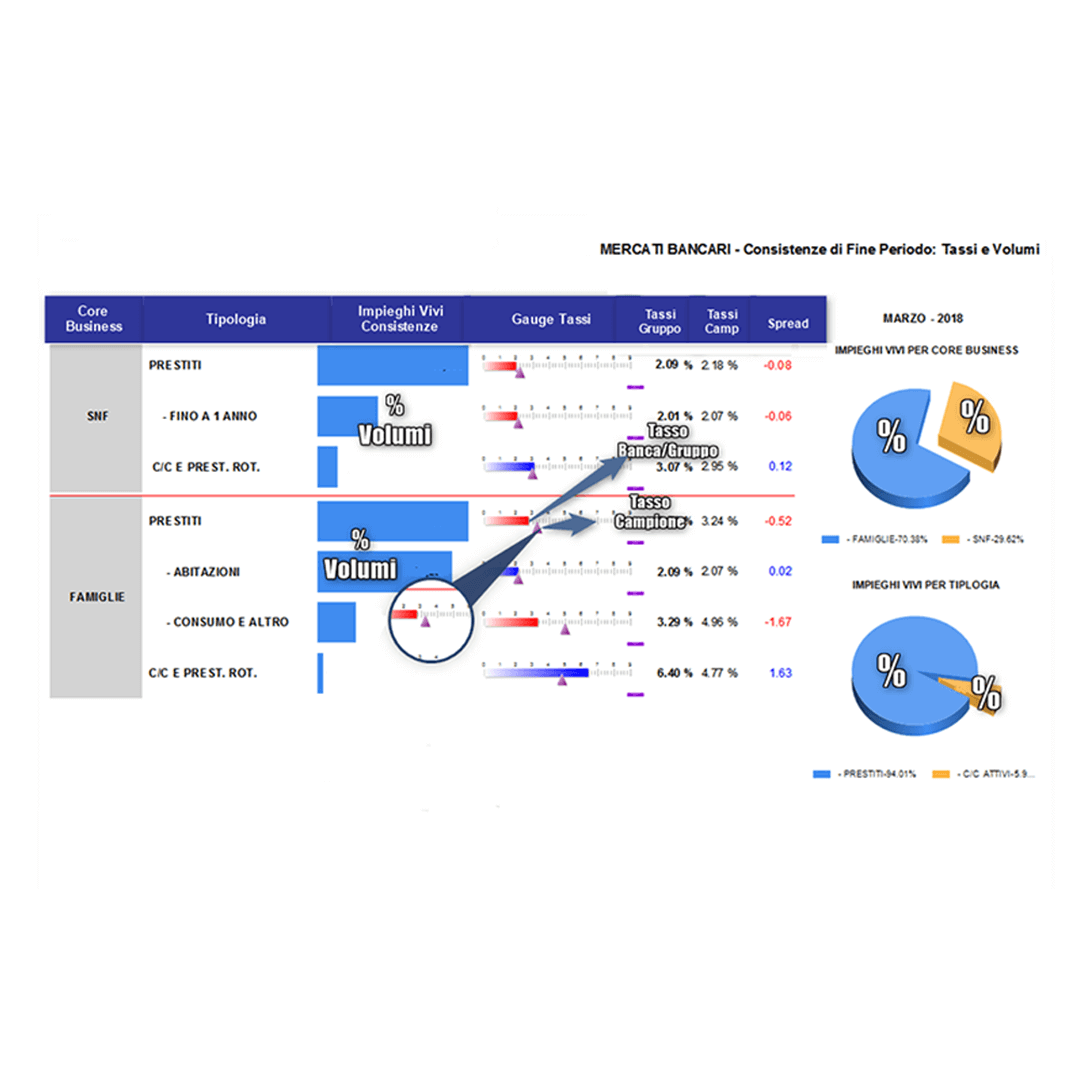

E-Books present comparative month-on-month analytics of average interest rates as set by the Bank/BHC for new loans and deposits with NFC and household consumers. All Bank/BHC data are paired with the published statistical data of the peer group.

Highlights

New-business interest-rate analytics are grouped according to the type of loan or deposit (eg: revolving loan vs. mortgage loan; checking account vs. term deposit) and according to the business industry type. Determining factors include: interest rate fixation, loan type (eg: real estate), and loan amount (eg: >$1-million).

Content

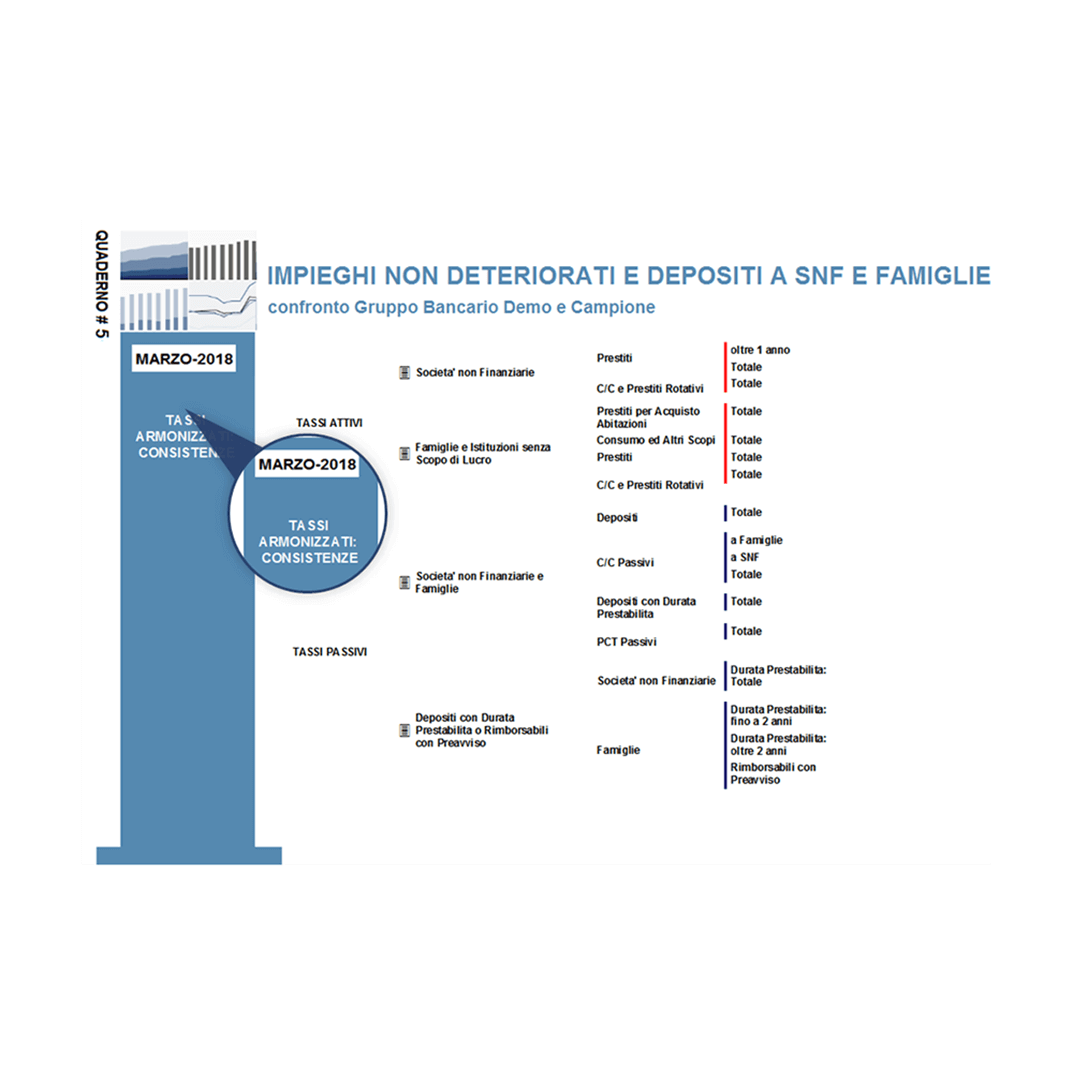

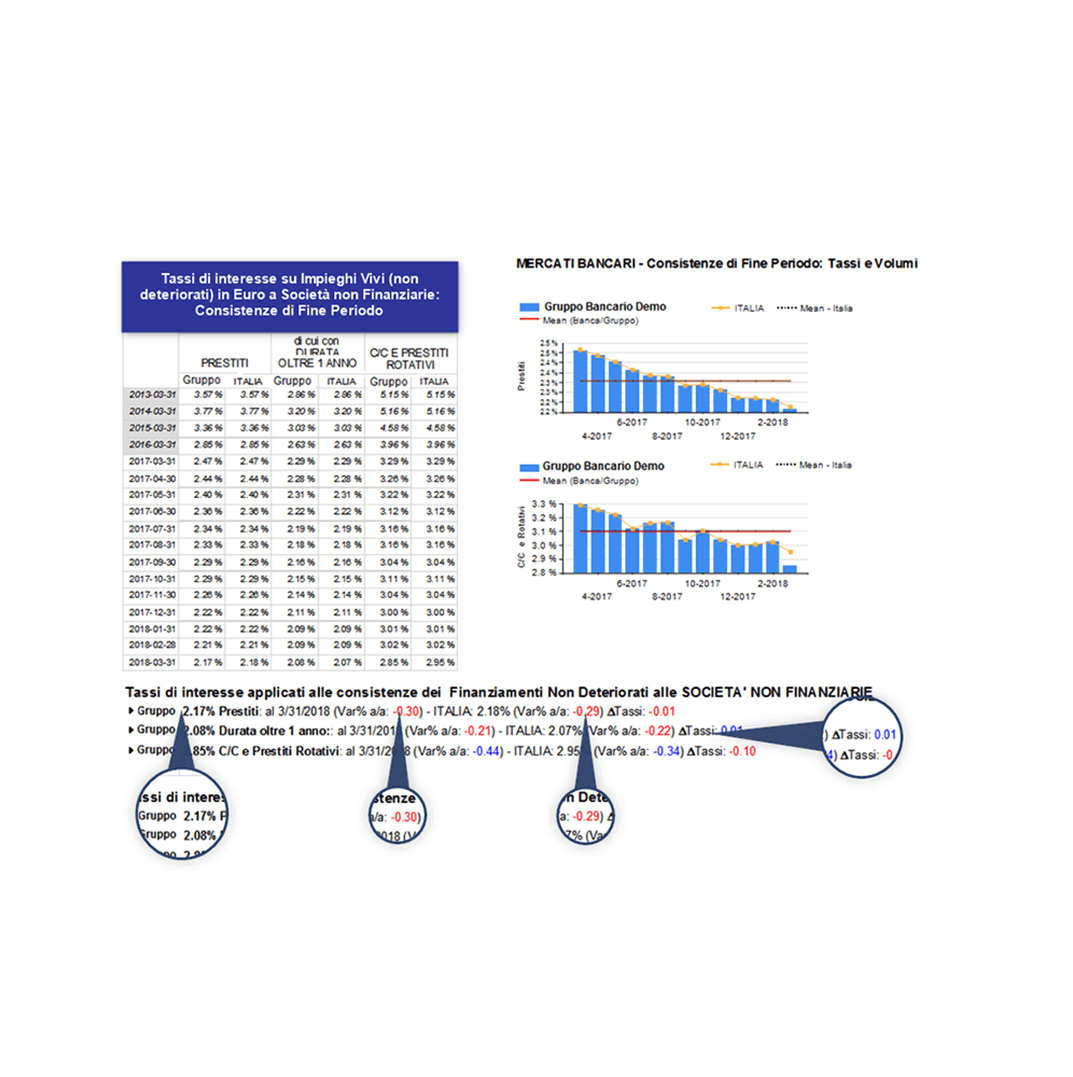

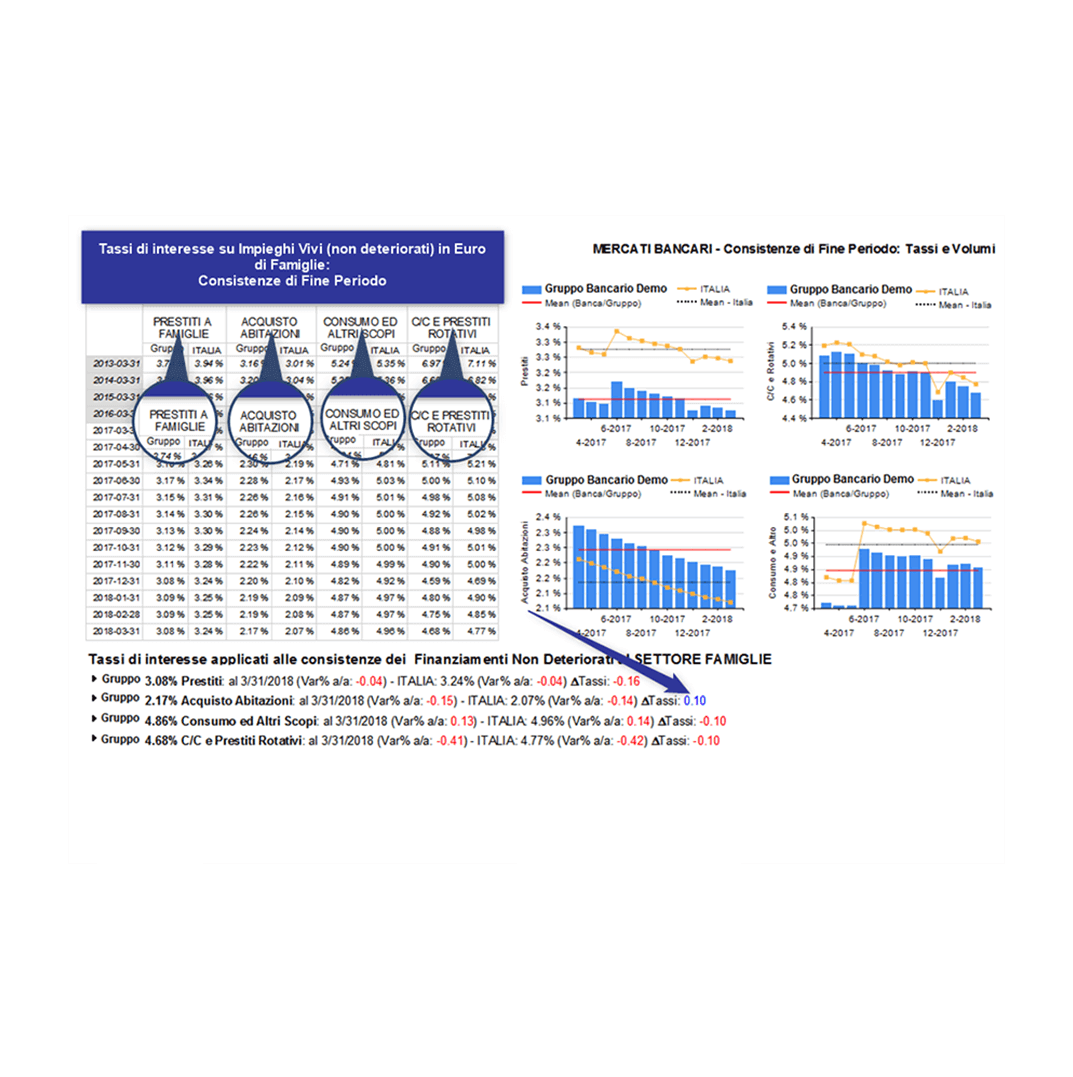

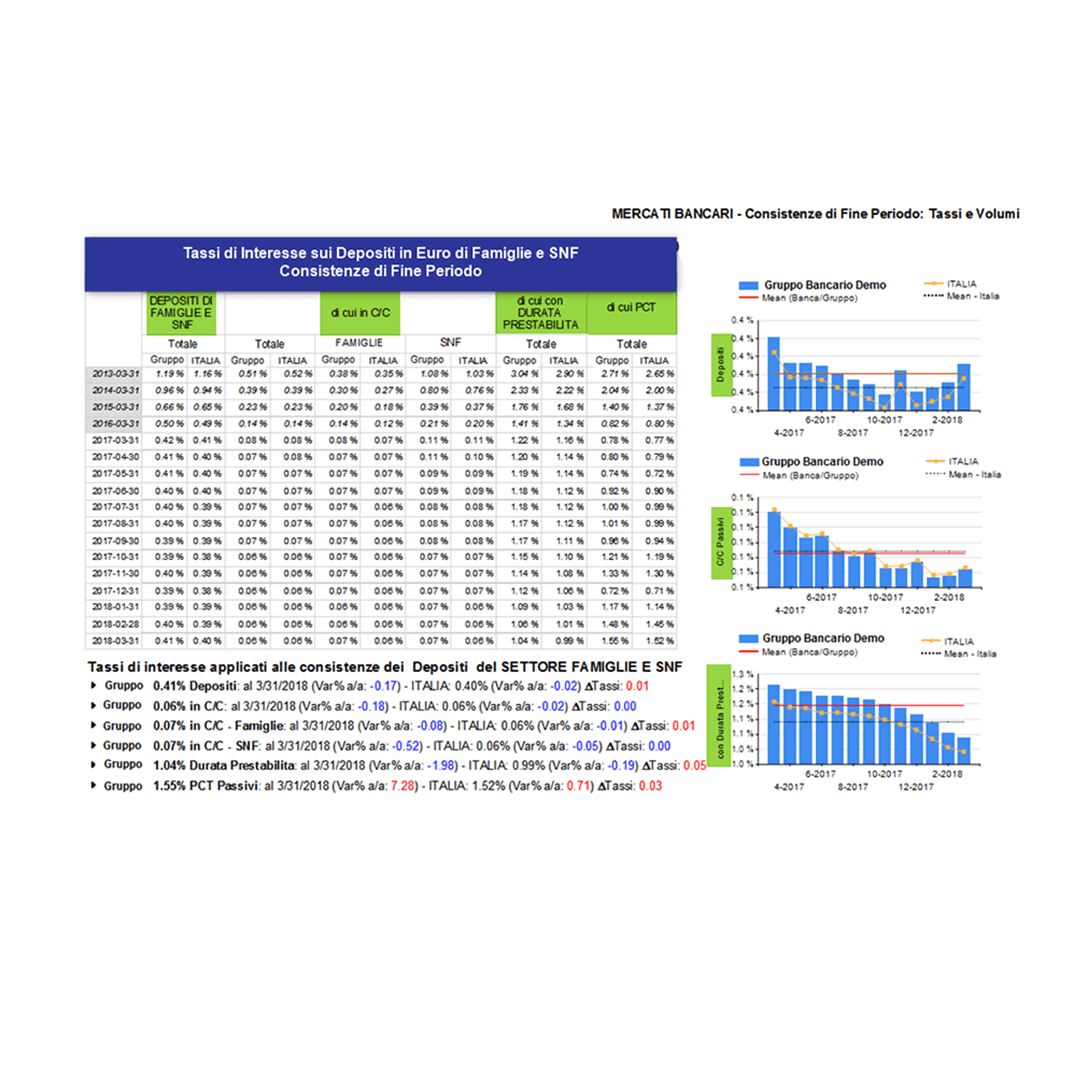

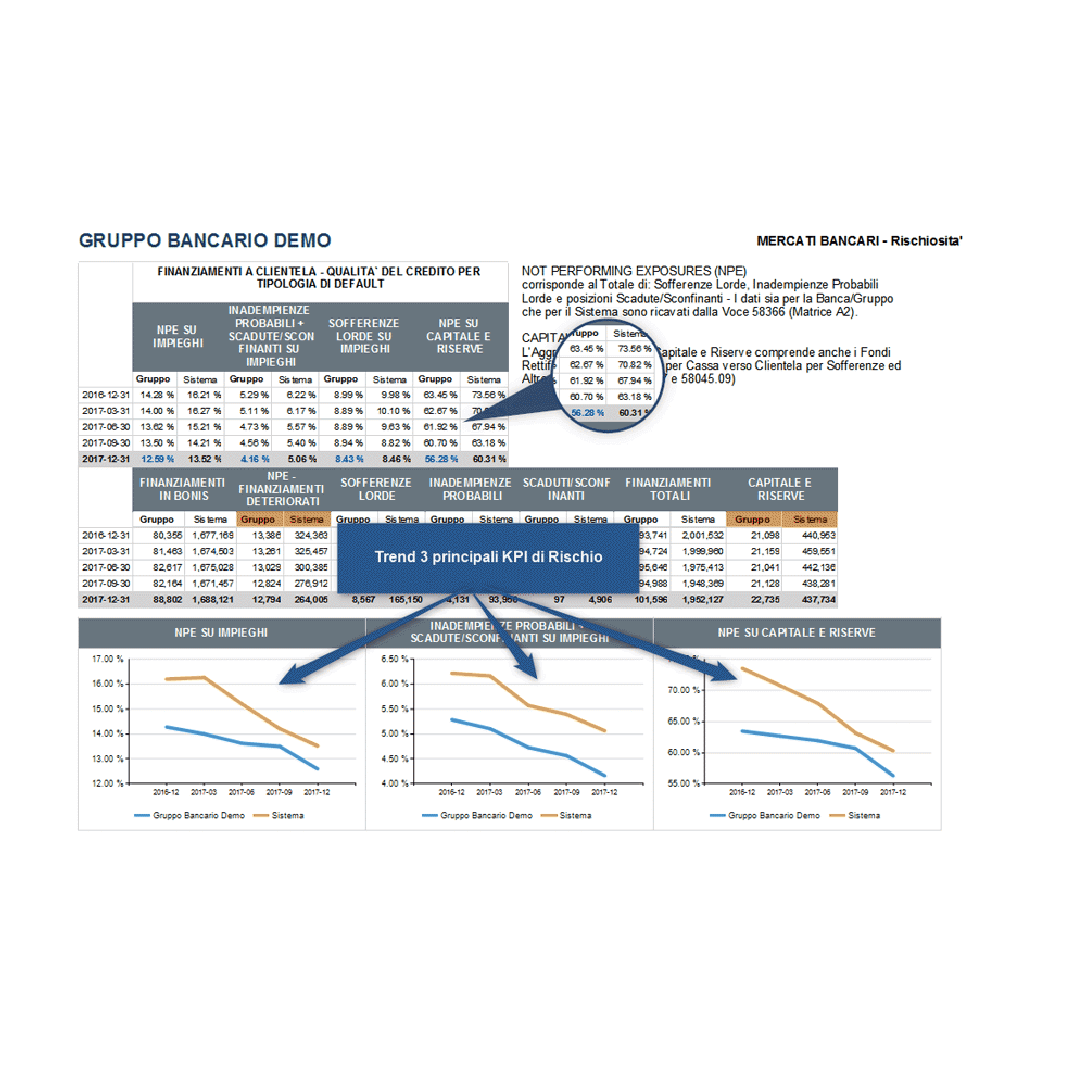

The E-Book presents analytics on average interest rates as set by the Bank/BHC to outstanding loans and deposits categorized by NFC and household consumers. All Bank/BHC data are paired with the published statistical data of the peer group.

Highlights

Visuals allow Executive Management to identify positive and negative spread aspects quickly and efficiently. Loan interest rates for the "in current good standing" are reported.

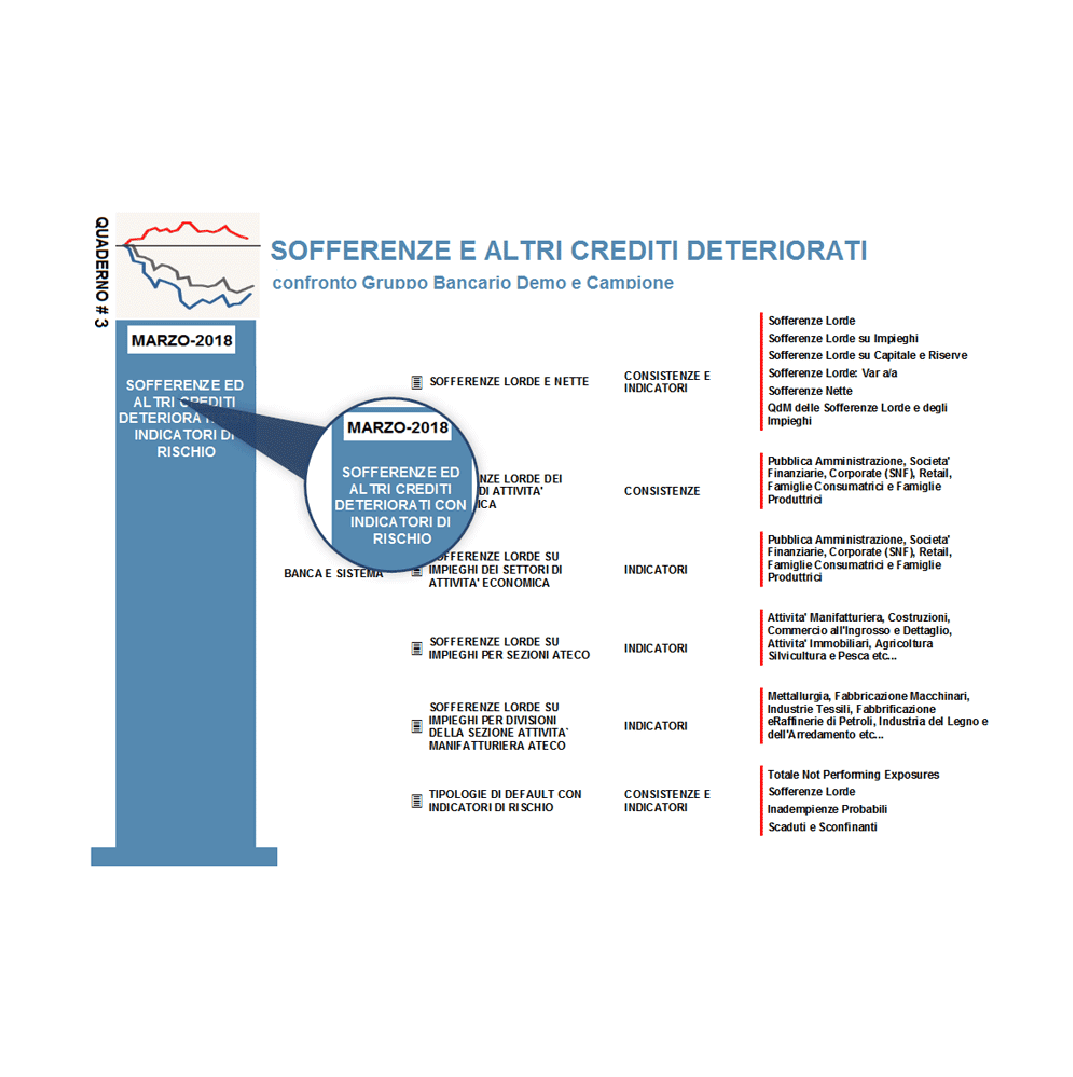

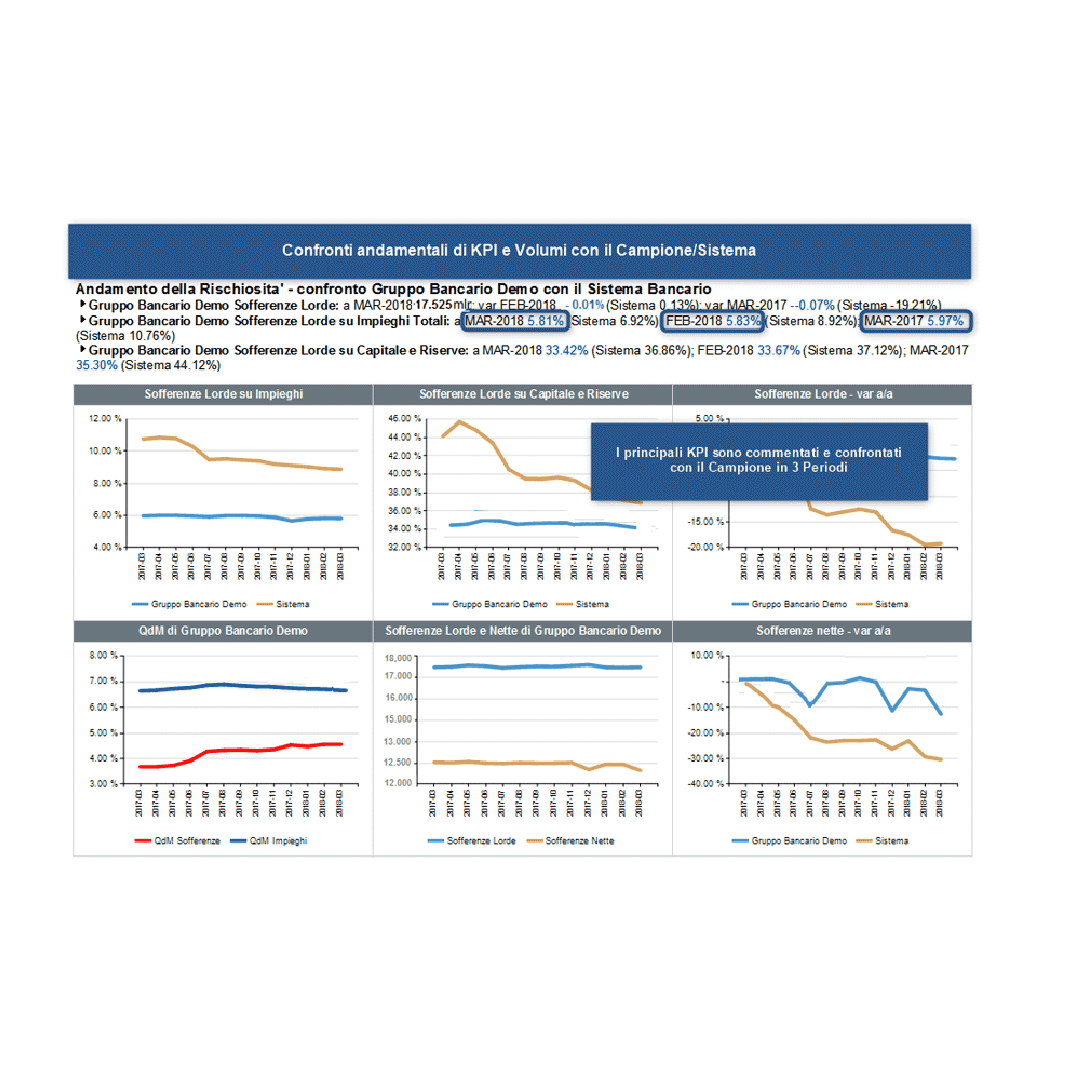

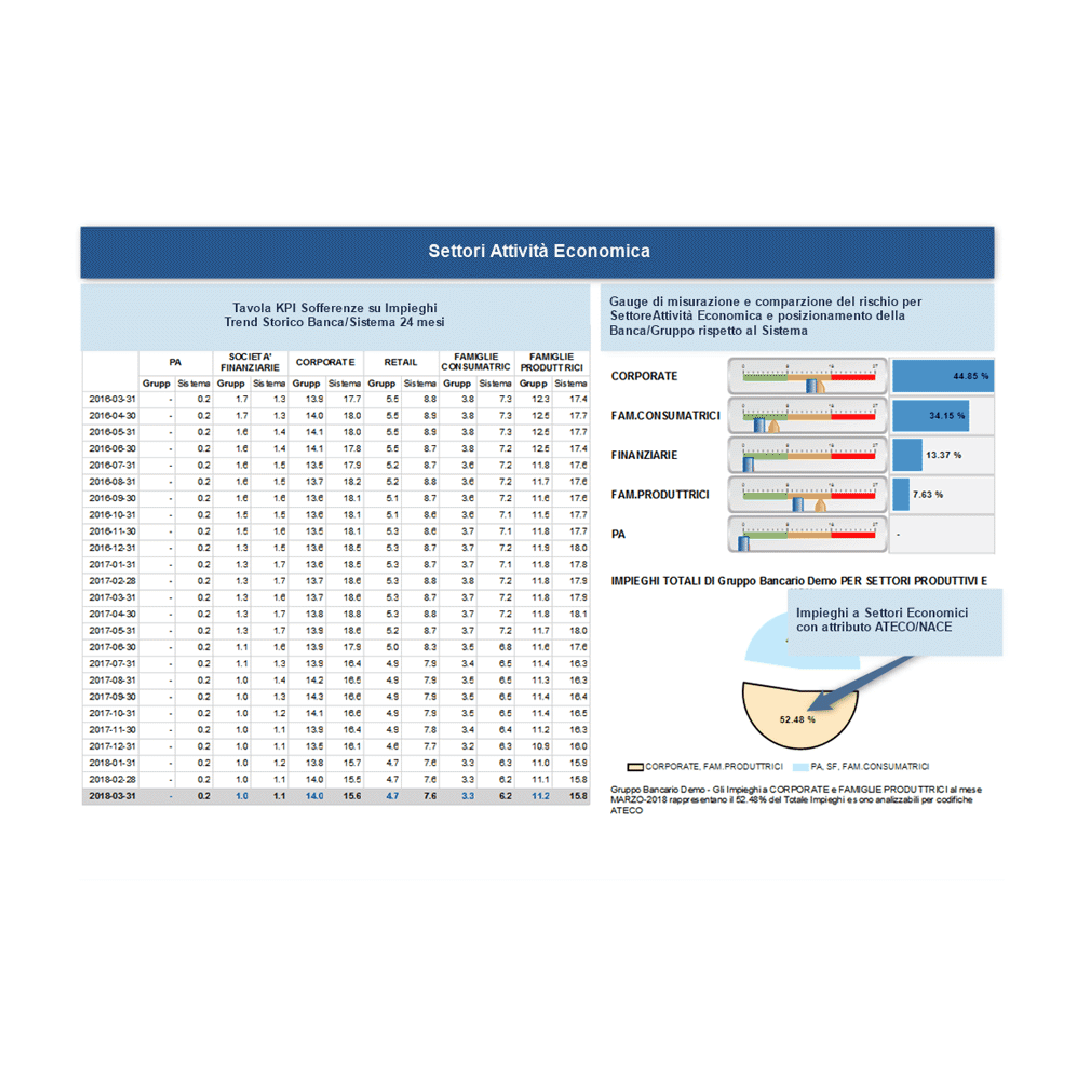

Content

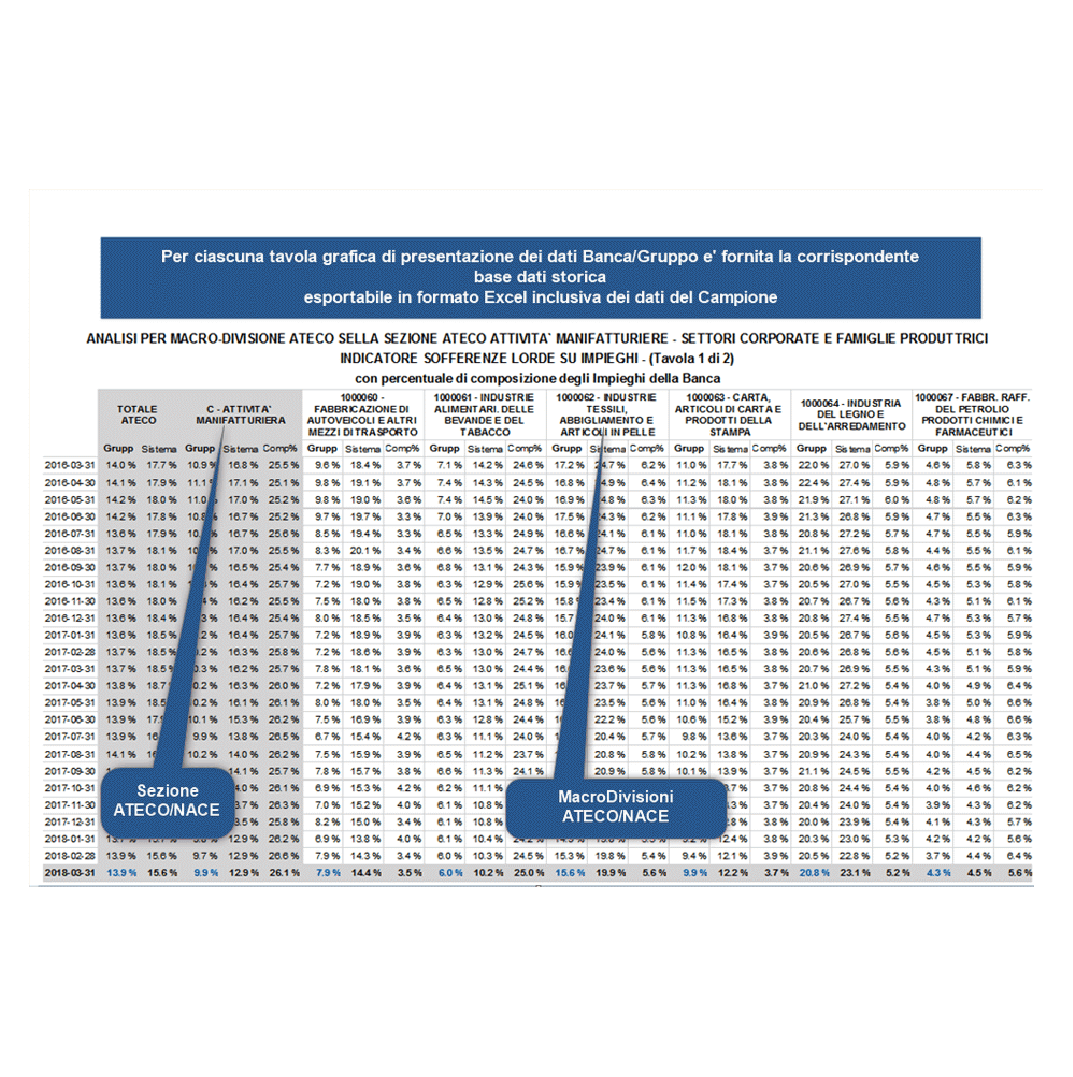

The E-Book presents in default (NPL) loans by location, industry and economic sector. All Bank/BHC data are paired with the published statistical data of the peer group.

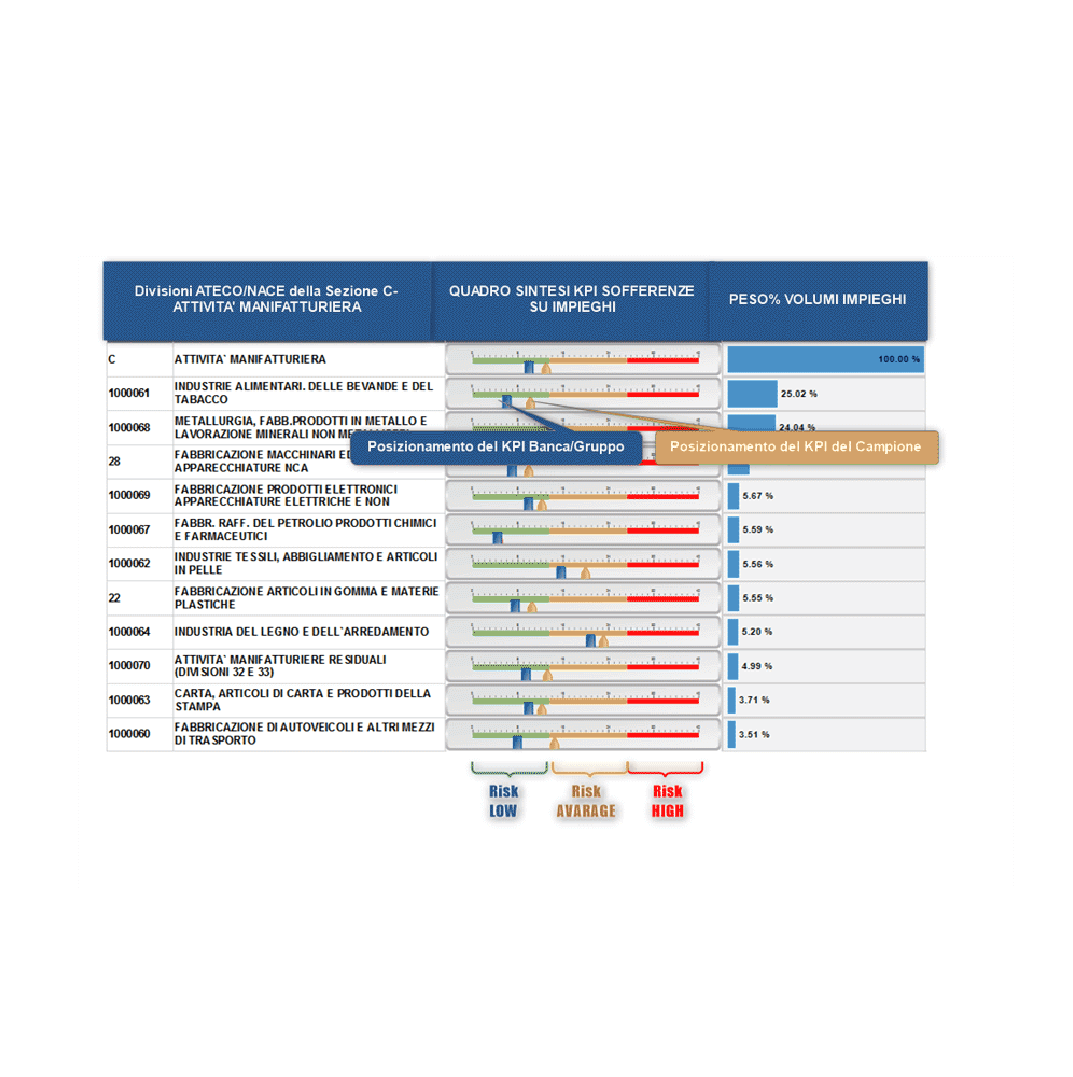

Highlights

The Bank/BHC Indicator of Non-Performing Loans as a percentage of Total Loans is analysed via Industry and NACE classifications and all data are paired with the corresponding Indicators of the peer group. The analytics allow the Bank/BHC to identify extremes as well as trends of credit risk from both Bank/BHC and market perspectives. Non-performing consumer loans are also analysed according to type (eg: housing vs. credit-card or consumer-credit loans). Data are reported under different classifications including impaired loans, charge-offs, allowances, and capital-adequacy Key Performance Indicators (KPIs).