THE BANK/BHC AND ITS REGIONAL COMPETITORS

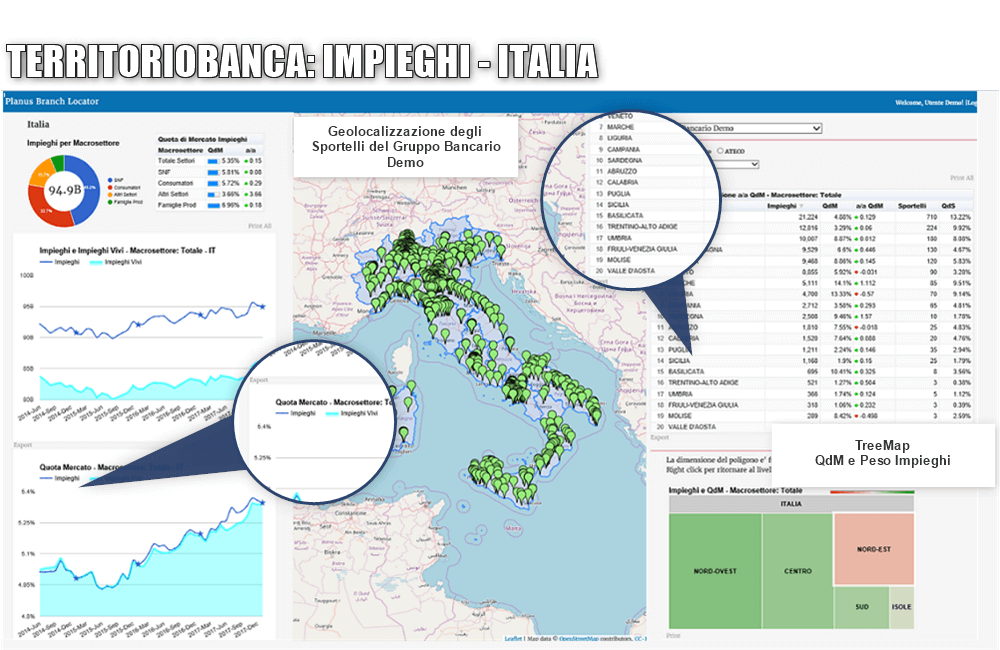

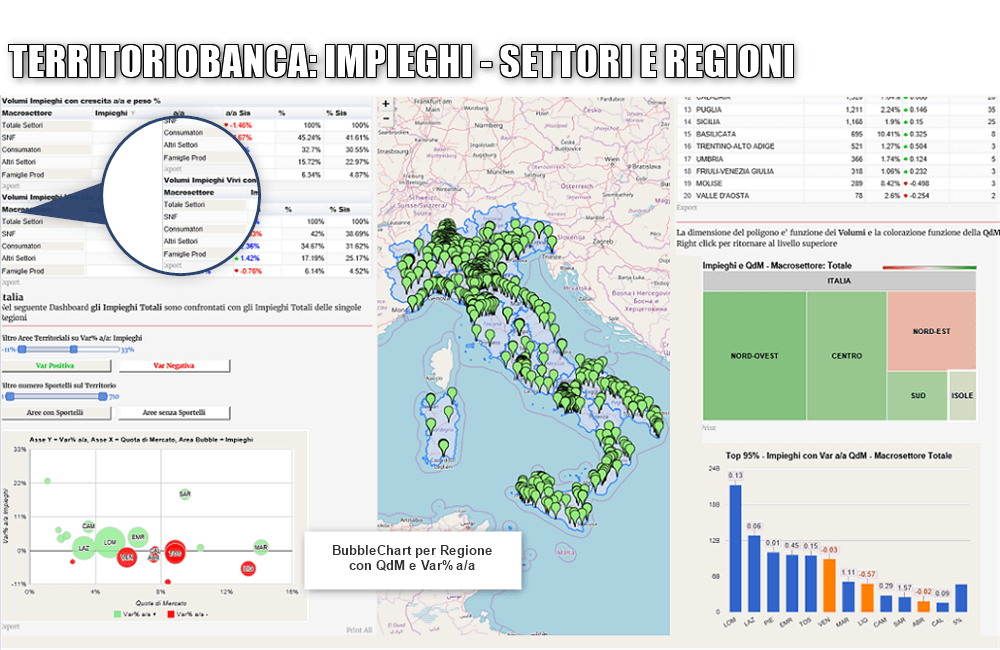

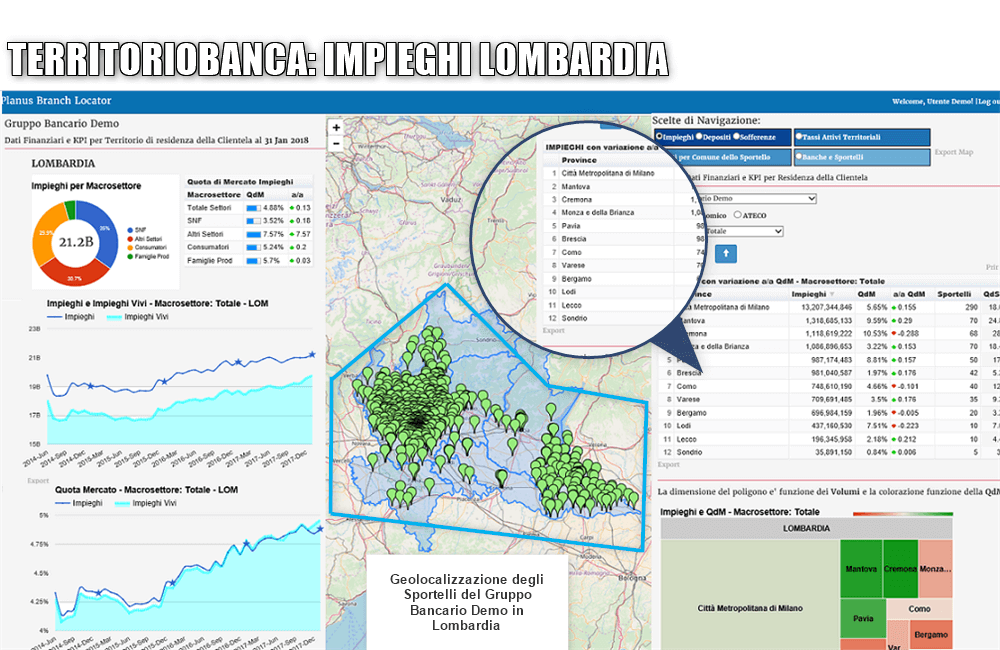

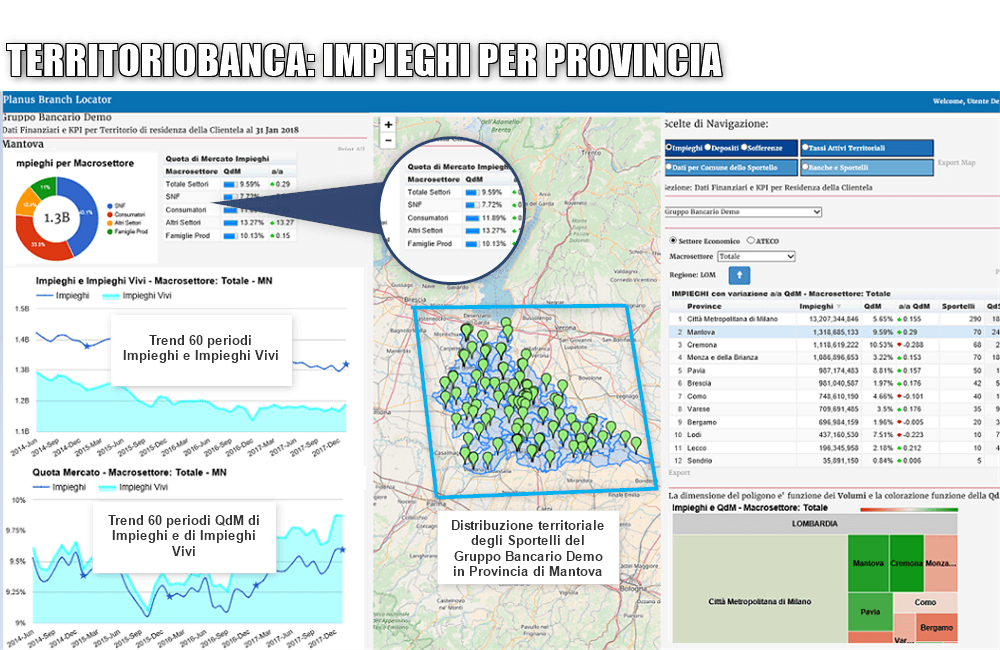

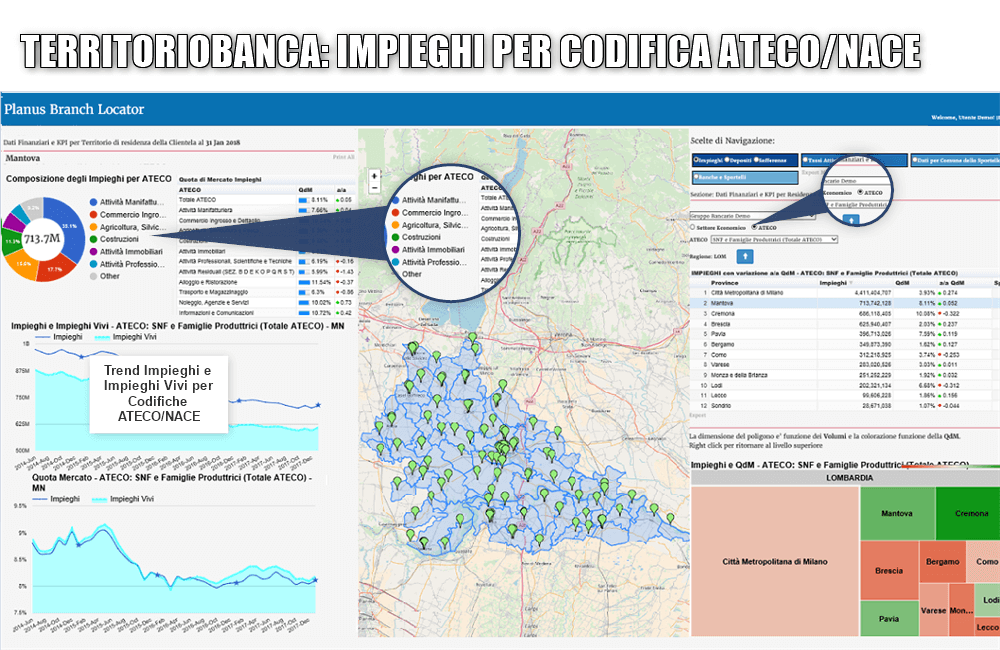

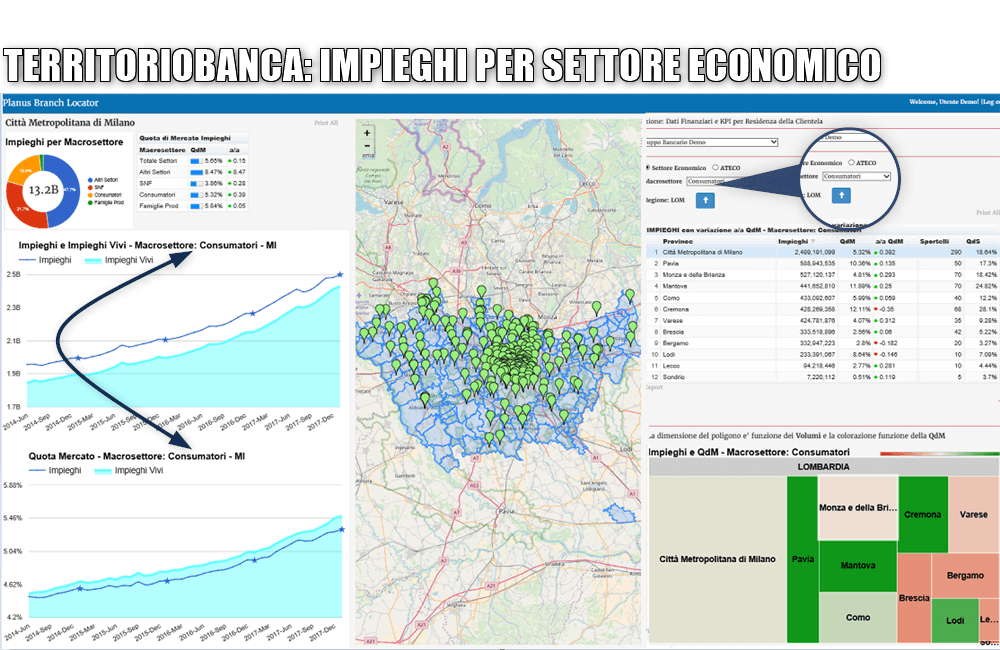

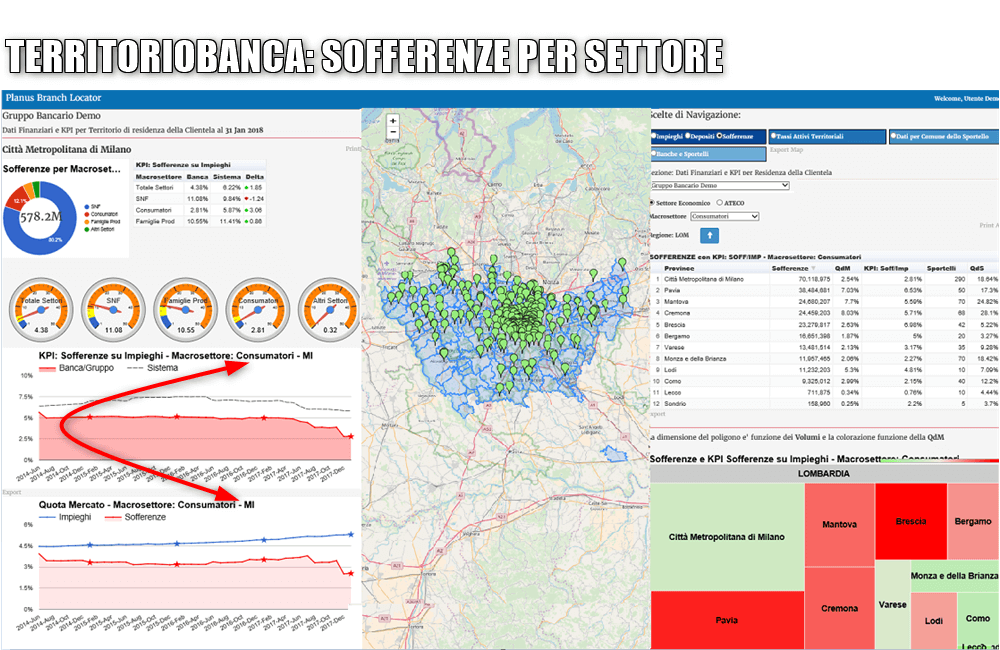

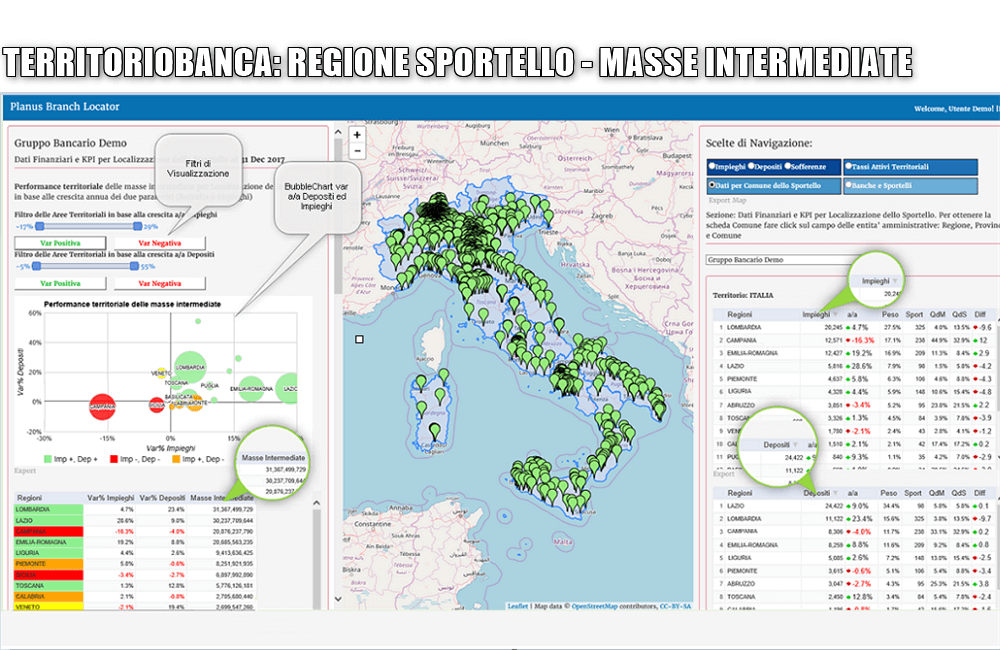

TerritorioBanca provides at-a-glance key financial statistics of the Bank/BHC and its competitors. The statistical information is enhanced by a live Geocoding/Mapping system that shows the branch locations of both the Bank/BHC and its competitors.

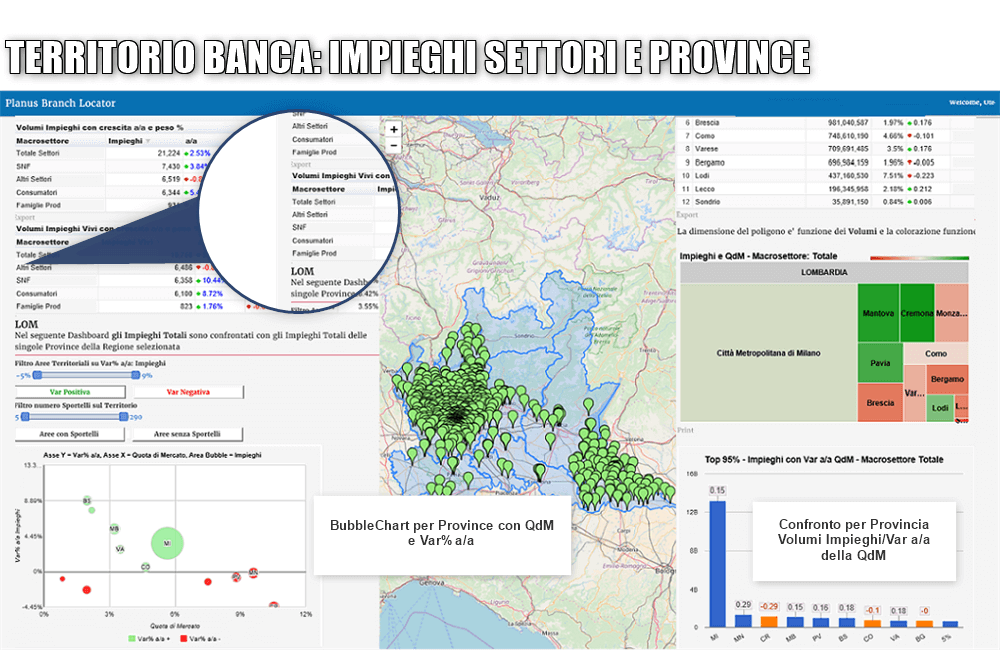

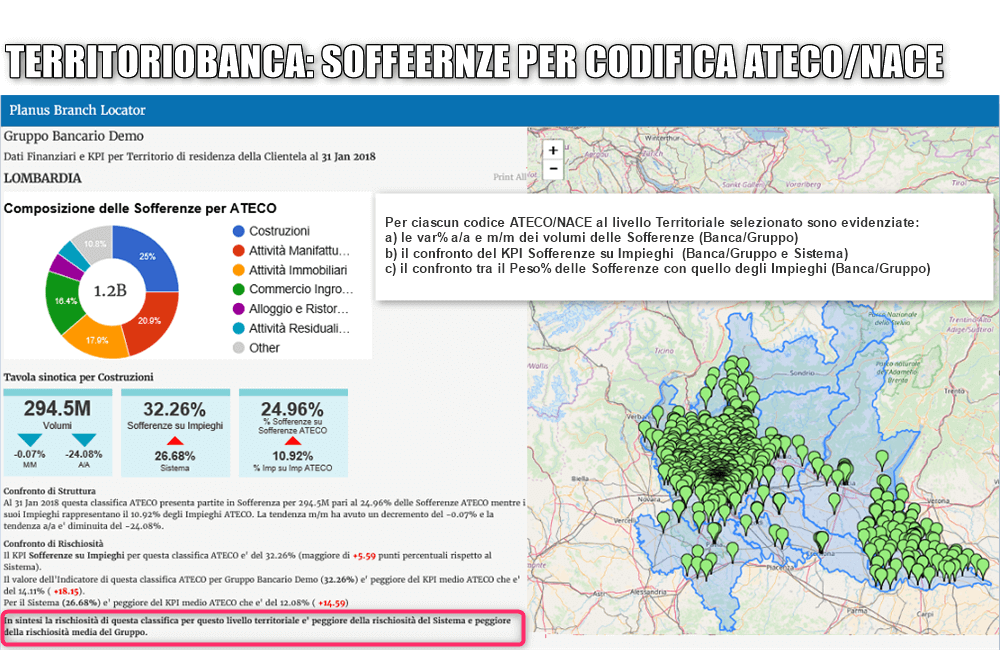

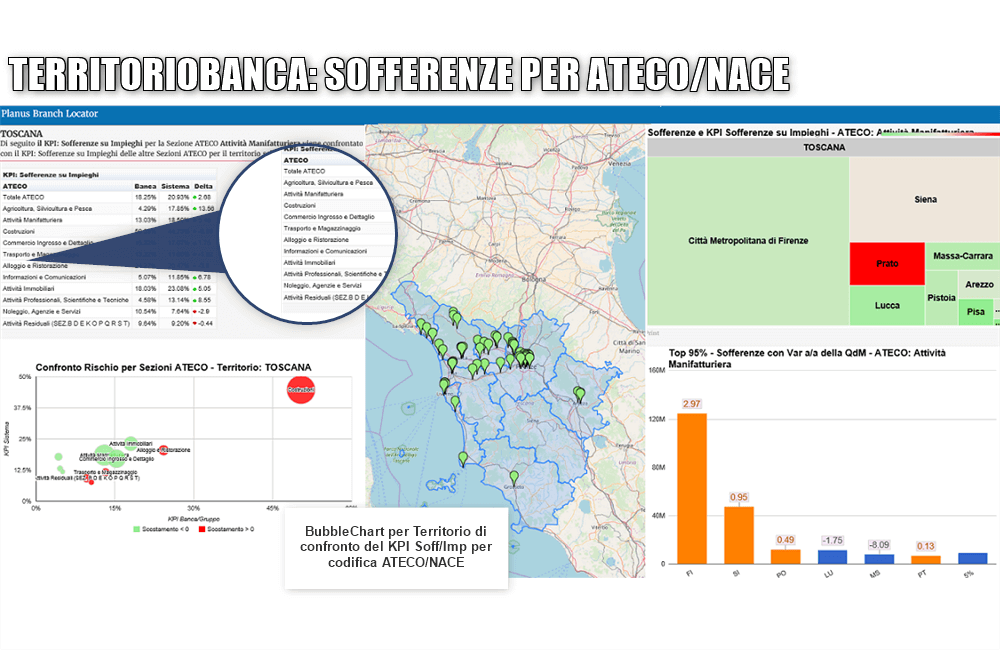

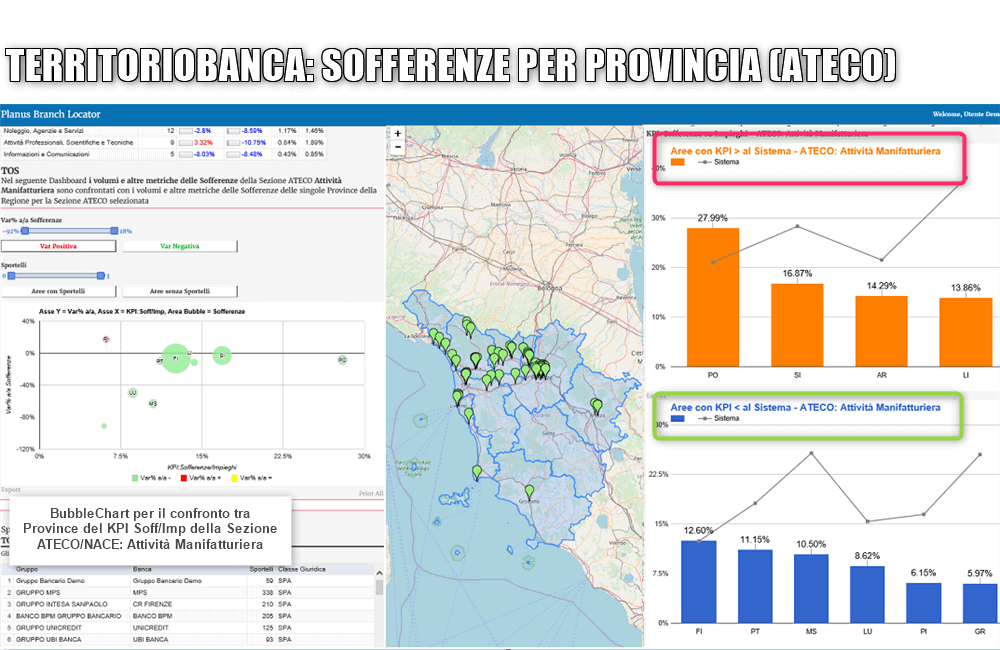

The Bank/BHC’s loans, deposits, NPLs and interest rates can be analysed in depth by both industry and economic sectors (NACE) via multiple layers of geographical administrative boundaries or within internal commercial areas as defined by the financial institution.

Regional Bank/BHC performance data are enhanced by interactive visual displays presenting readily understandable, synthesized analysis of the most significant performance benchmarks and trends.

Branch Geocoding is available by street address, municipality, county, region, macro-region, or a pre-defined distance from any other address.

Monitoring loans, deposits, and NPLs

- A suite of Dashboards drives detailed analysis of the Bank/BHC’s services including loans, deposits, and NPLs summarized by Customer Industry, Customer Economic Activity (NACE), Customer County of Residence or Branch Municipality.

Loans and Deposits Module

Country Level

Loans and Deposits Module

Performance by Industry and Region

Loans and Deposits Module

By Lombardia and it's Counties

Loans and Deposits Module

By Lombardia County Level

Loans and Deposits Module

Historical Performance Trends with Market Share

Loans and Deposits Module

Loans by County and Economic Sector (NACE)

Loans and Deposits Module

Consumers by Economic Sector

Loans and Deposits Module

Default by Industry and Location

Loans and Deposits Module

Default by Economic Sector and Location

Loans and Deposits Module

Risk Ranking by Economic Sector and Location

Loans and Deposits Module

Manufacturing Sector by County

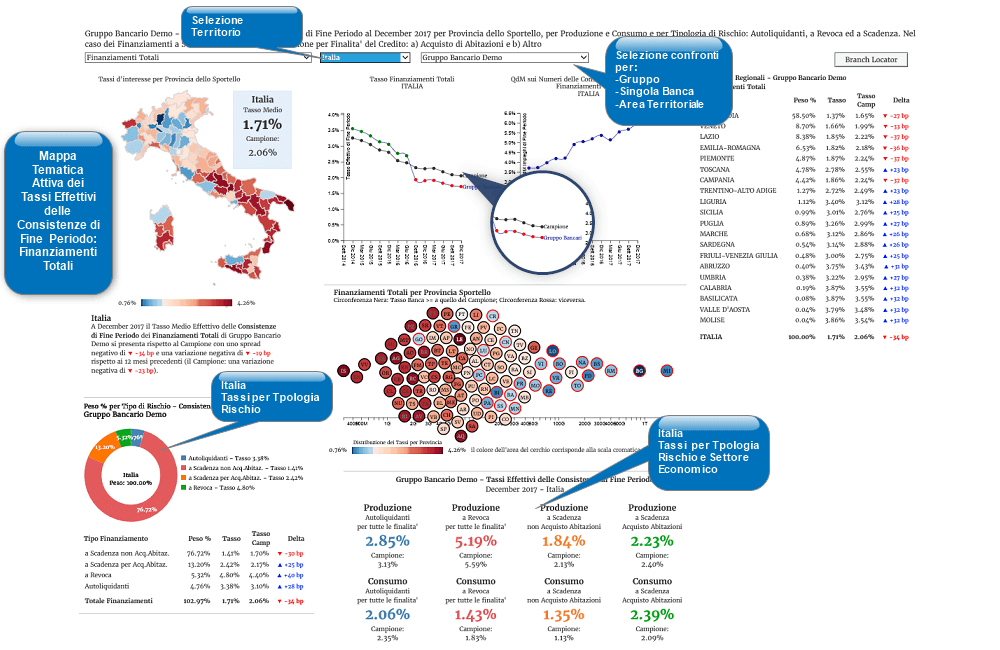

Analyzing loan interest rates

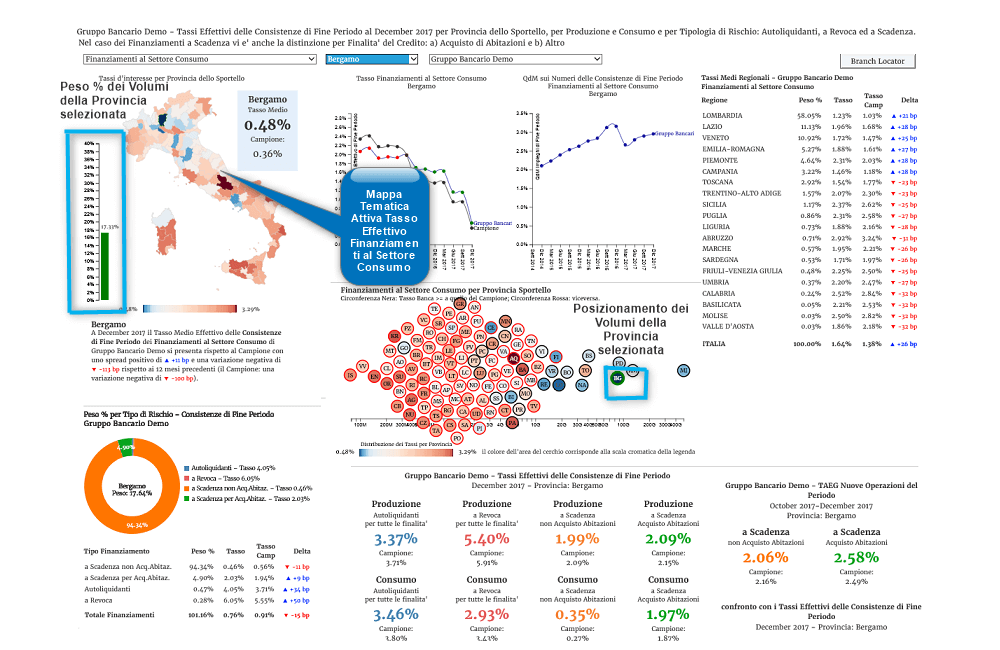

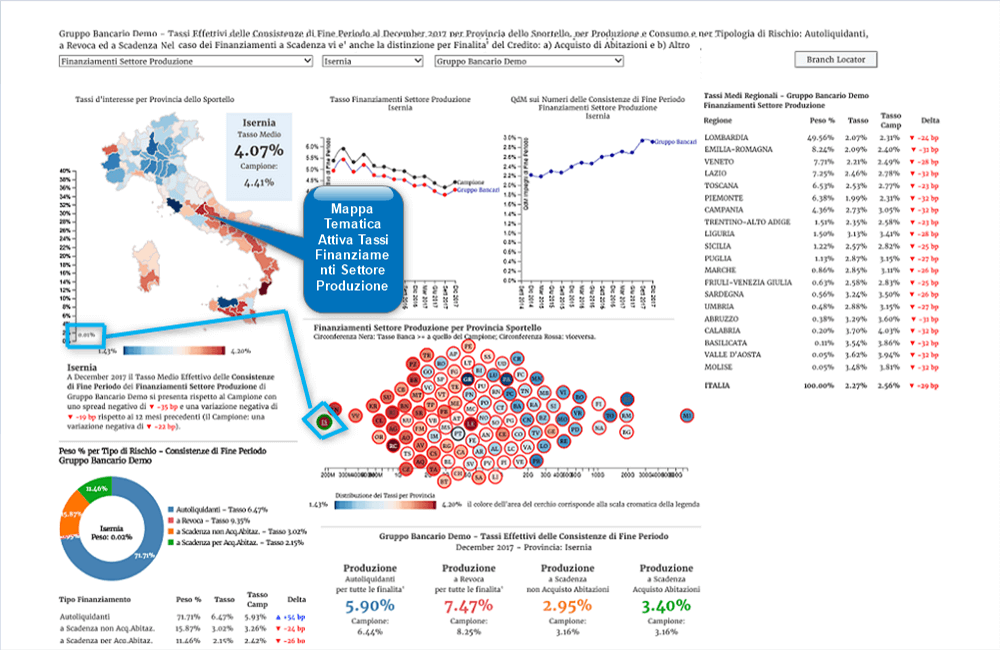

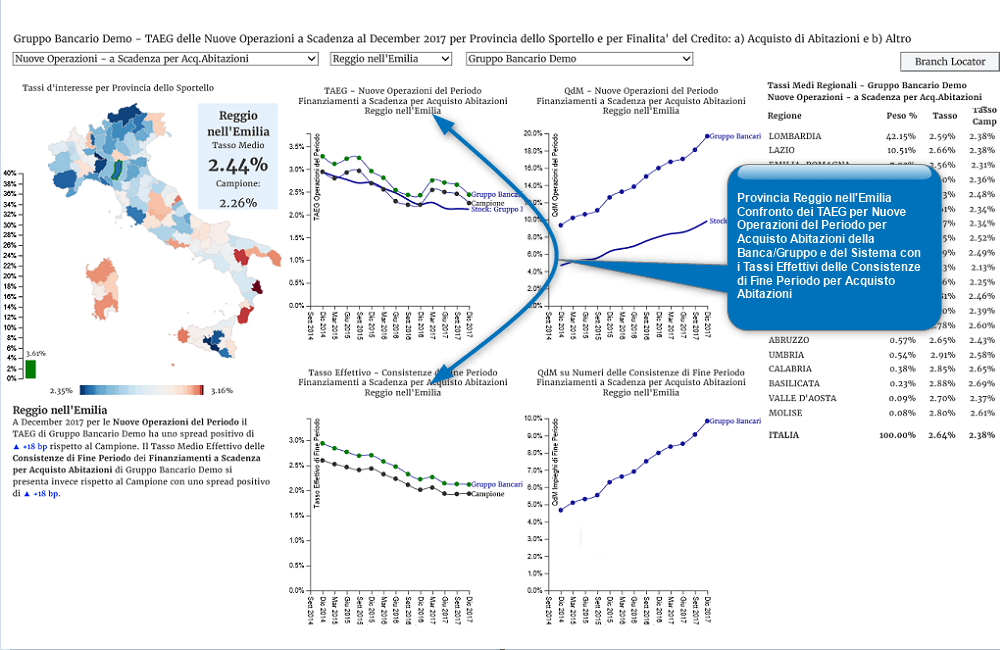

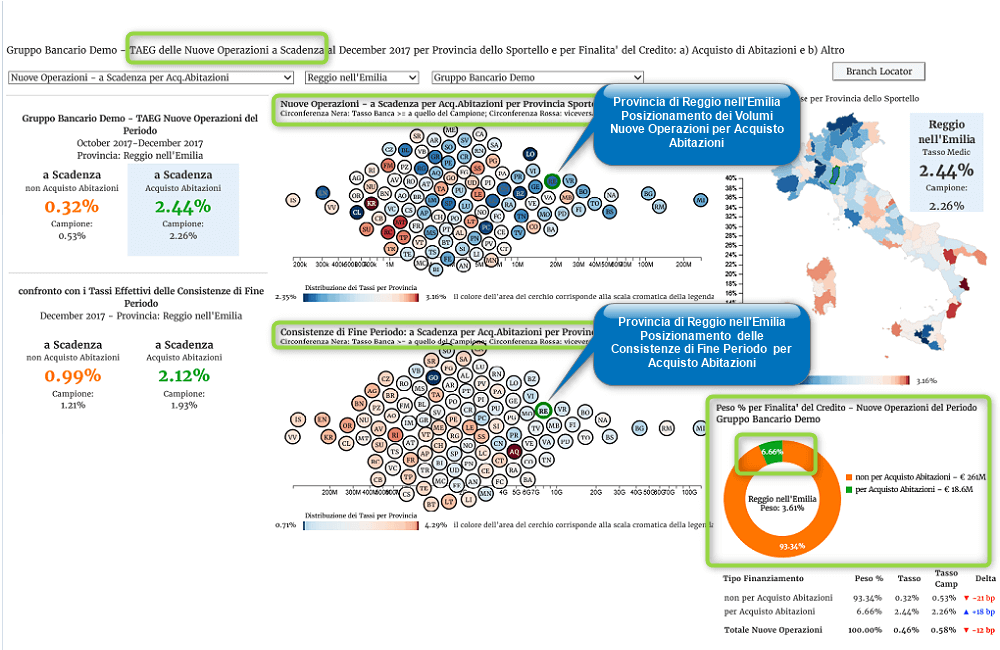

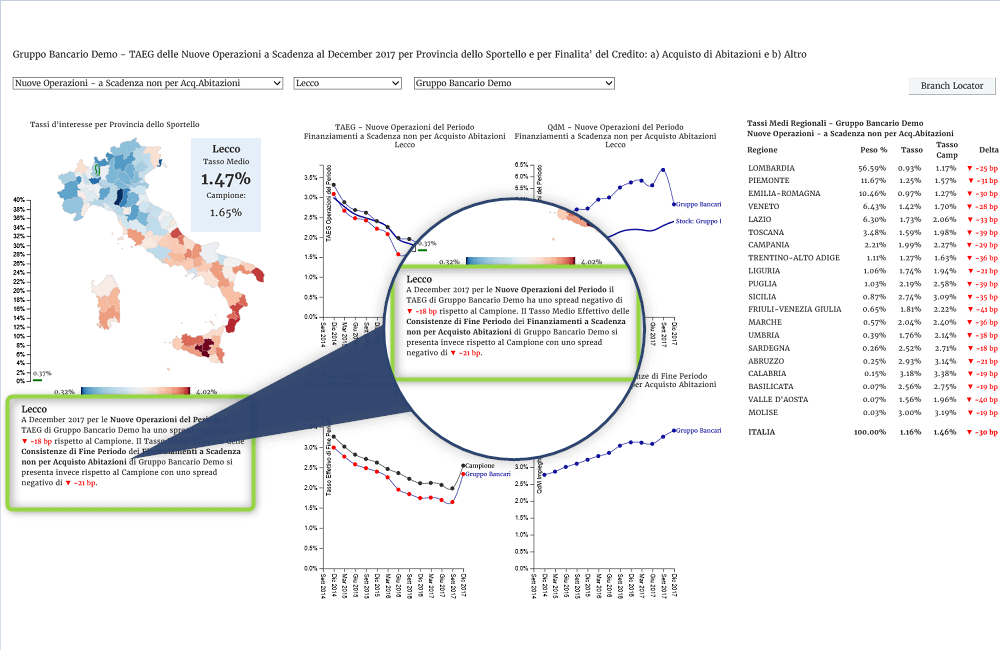

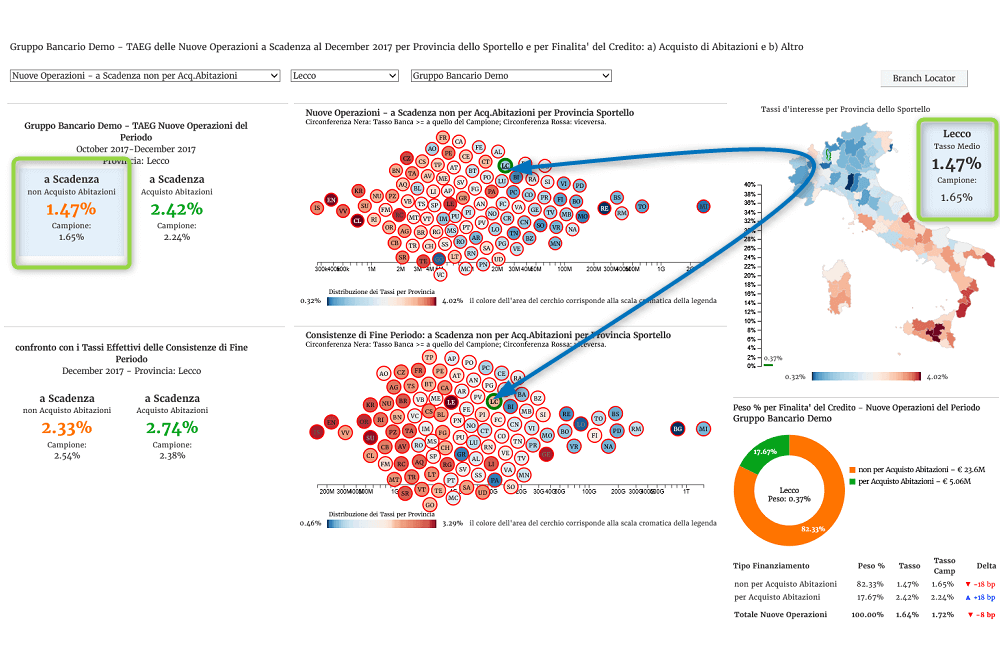

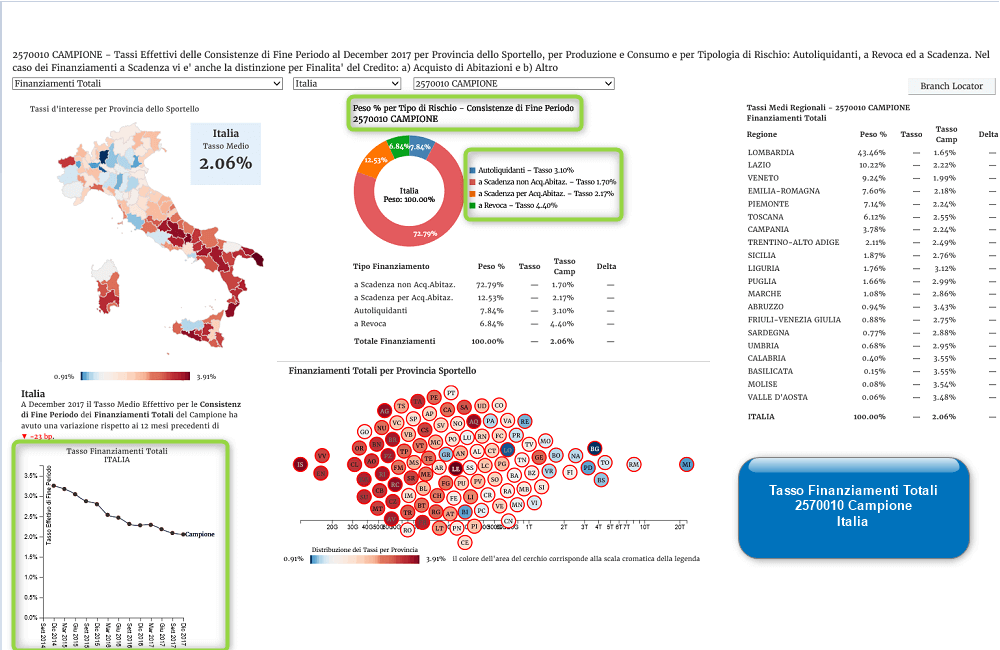

The Bank/BHC’s lending interest rates are summarized, analysed, and compared with the average rates of a peer group according to branch location, type of industry (e.g. Consumer vs. Producer), type of product (e.g. Mortgage Loan vs. Checking Account) and type of rate (e.g.Adjustable Rate vs. Fixed Rate). Period end mortgage loan interest rates are available along with new business loan interest rate by previous quarter.

With a range of filtering features, charts, and interactive thematic maps, the Dashboard presents all data necessary for comparative analysis at any given period in time as well as from a historical perspective.

Modulo Tassi Attivi

Confronto Tasso Finanziamenti Totali - Italia

Modulo Tassi Attivi

Confronto Tasso Finanziamenti Settore Consumo - Provincia di Bergamo

Modulo Tassi Attivi

Confronto Tasso Finanziamenti Settore Produzione - Provincia di Isernia

Modulo Tassi Attivi

Confronto Tasso Nuove Operazioni per Acquisto Abitazioni - Provincia di Reggio nell’Emilia (parte I)

Modulo Tassi Attivi

Confronto Tasso Nuove Operazioni per Acquisto Abitazioni - Provincia di Reggio nell’Emilia (parte II)

Modulo Tassi Attivi

Confronto Tasso Nuove Operazioni Non per Acquisto Abitazioni - Provincia di Lecco (parte I)

Modulo Tassi Attivi

Confronto Tasso Nuove Operazioni Non per Acquisto Abitazioni - Provincia di Lecco (parte II)

Modulo Tassi Attivi

Tasso Effettivo delle consistenze di fine periodo dei Finanziamenti - Dati del solo Campione - Italia

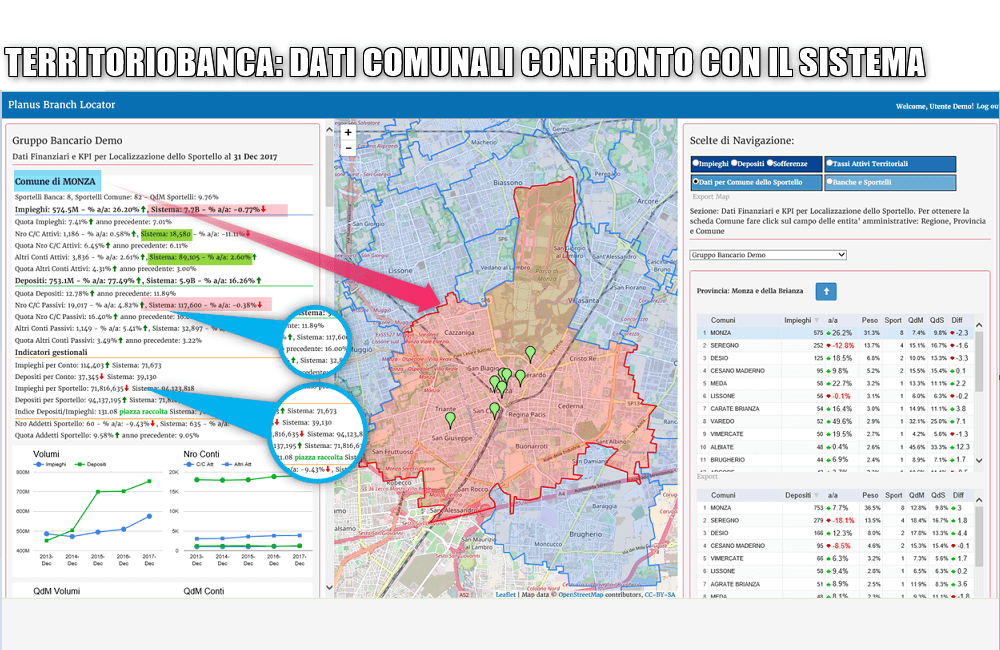

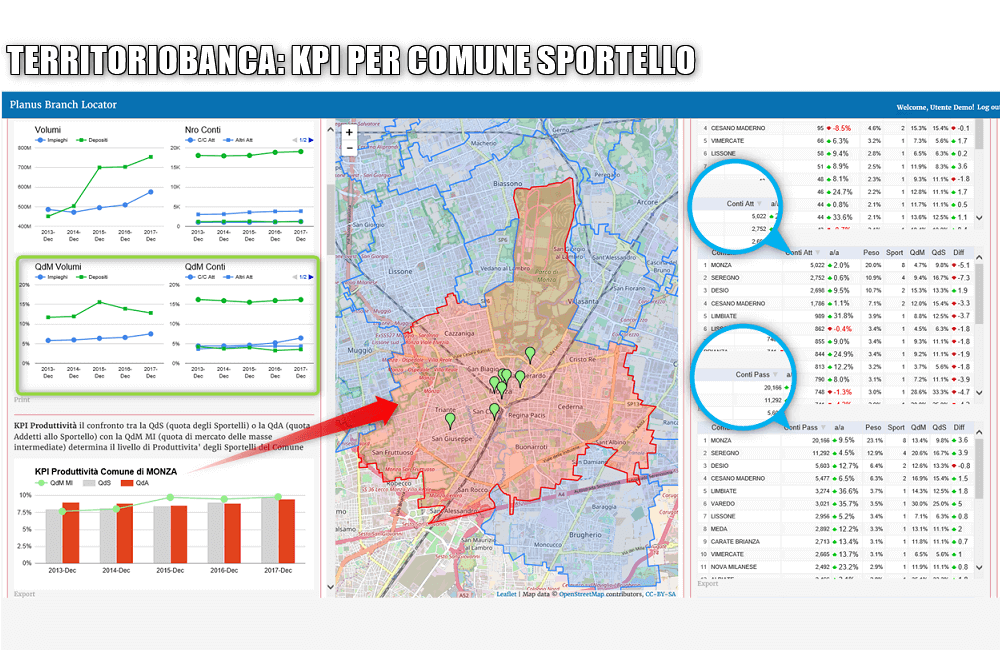

Financial Services and ISTAT demographic information by Branch Municipality

- ●Total Loans

- ●Total Deposits

- ●Total Number of Loans/Deposit Accounts

- ●Number of Employees

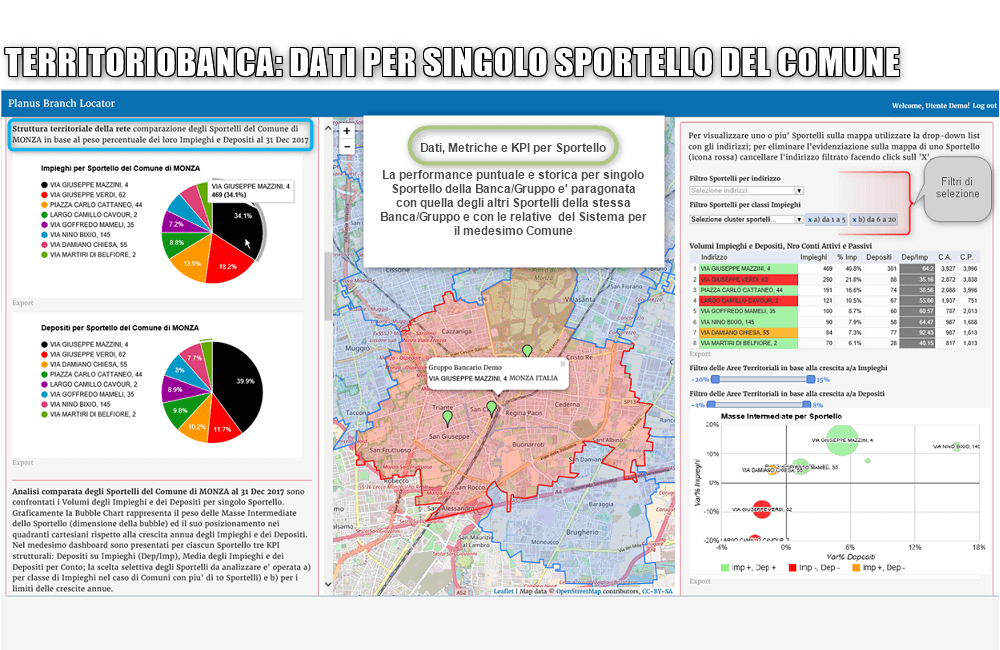

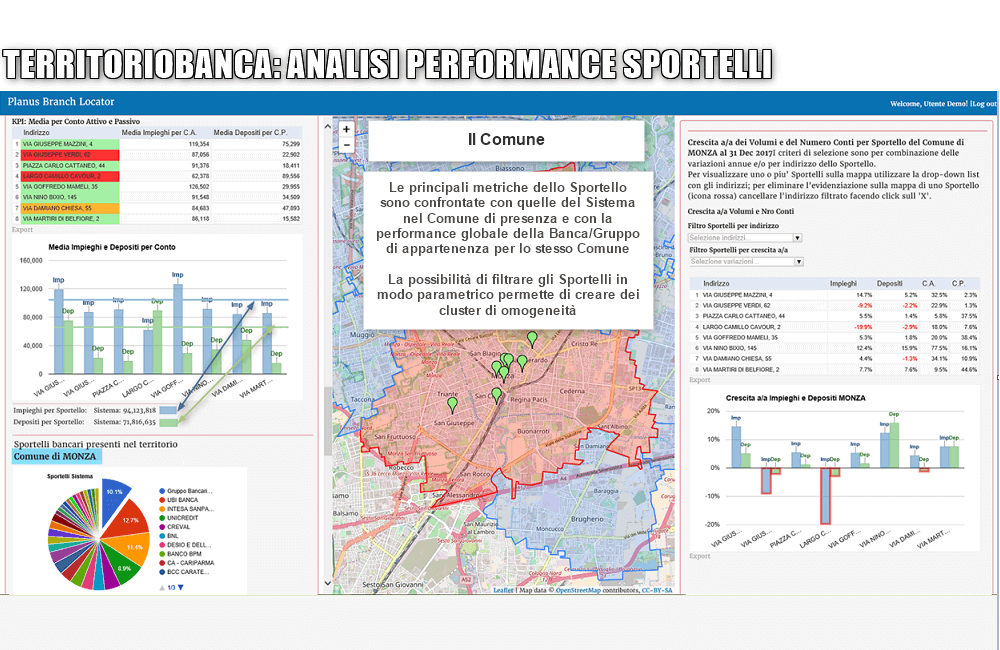

The most important financial measures and indicators of the Bank/BHC are compared with average measures and indicators of a peer group within the Municipality. This is the most in-depth analysis layer provided by the Italian banking industry and because of data protection is only available to those Municipalities with three or more Bank/BHCs branches.

At Municipality level, the available data includes:

ISTAT (Census) demographic information of each Municipality—including geographical area, population density, and relative rankings—interact with financial analytics to provide a unique multi-layered tool to enhance and drive the Bank/BHC’s business decisions.

Modulo Comuni

Dati di confronto per Regioni Sportello: Masse Intermediate

Modulo Comuni

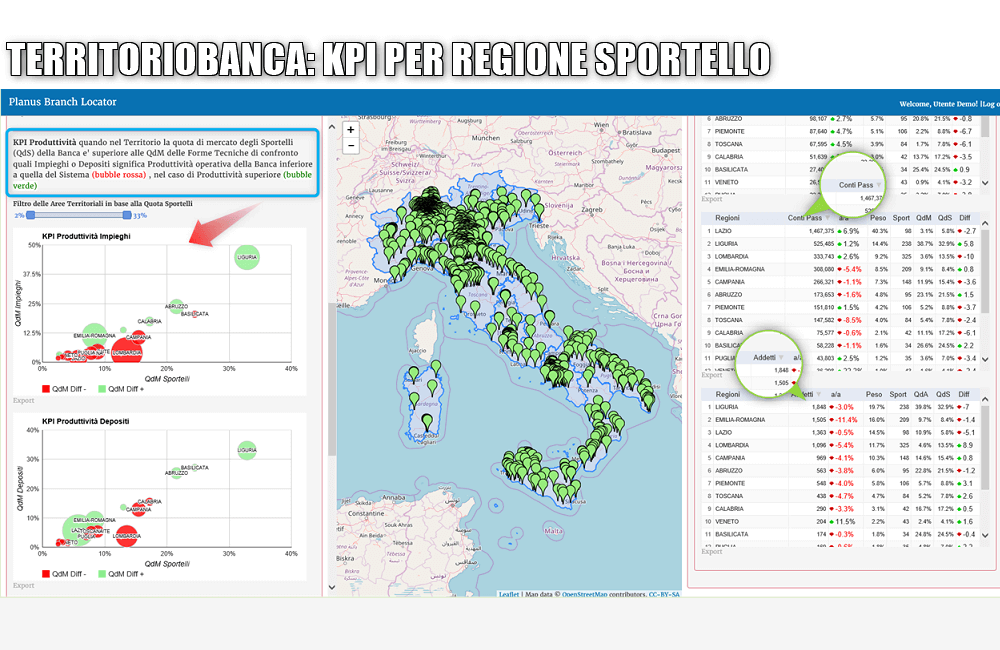

KPI di confronto per Regioni Sportello

Modulo Comuni

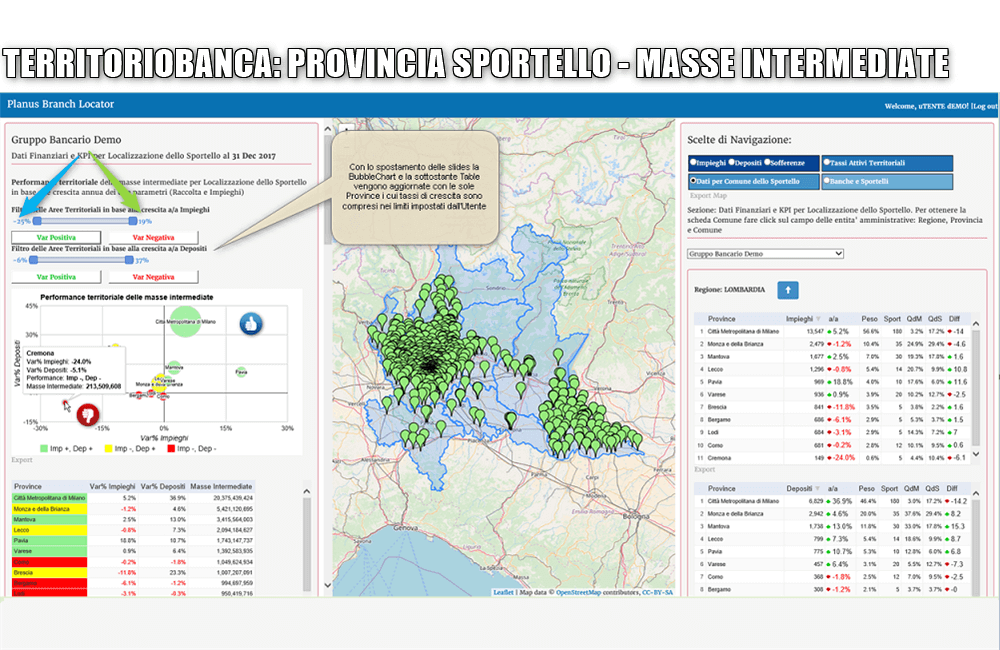

Dati di confronto per Province Sportello: Masse Intermediate

Modulo Comuni

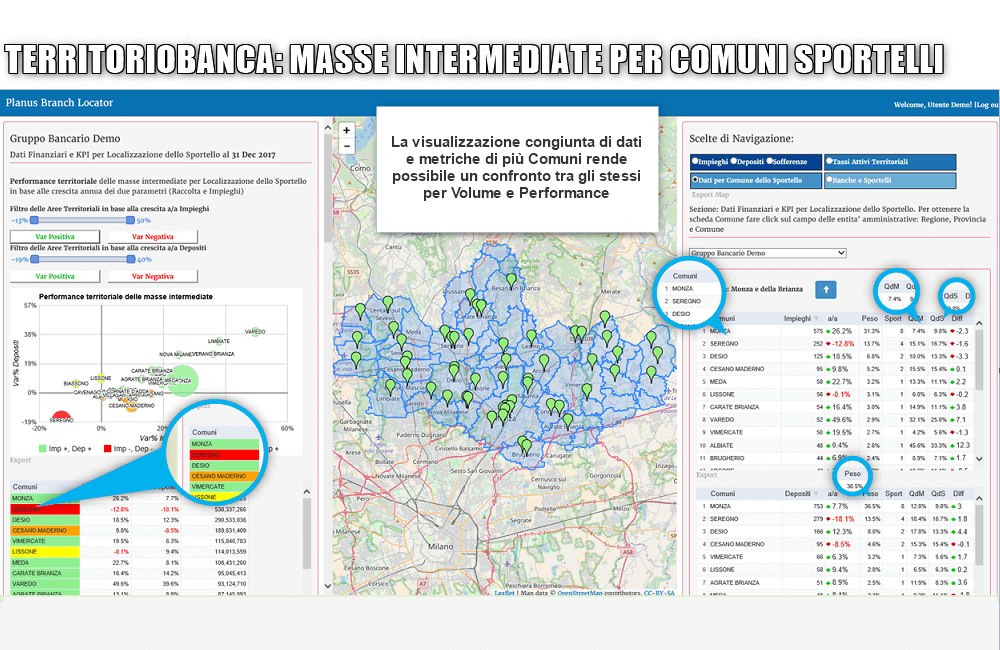

Dati di confronto per Comuni Sportello: Masse Intermediate

Modulo Comuni

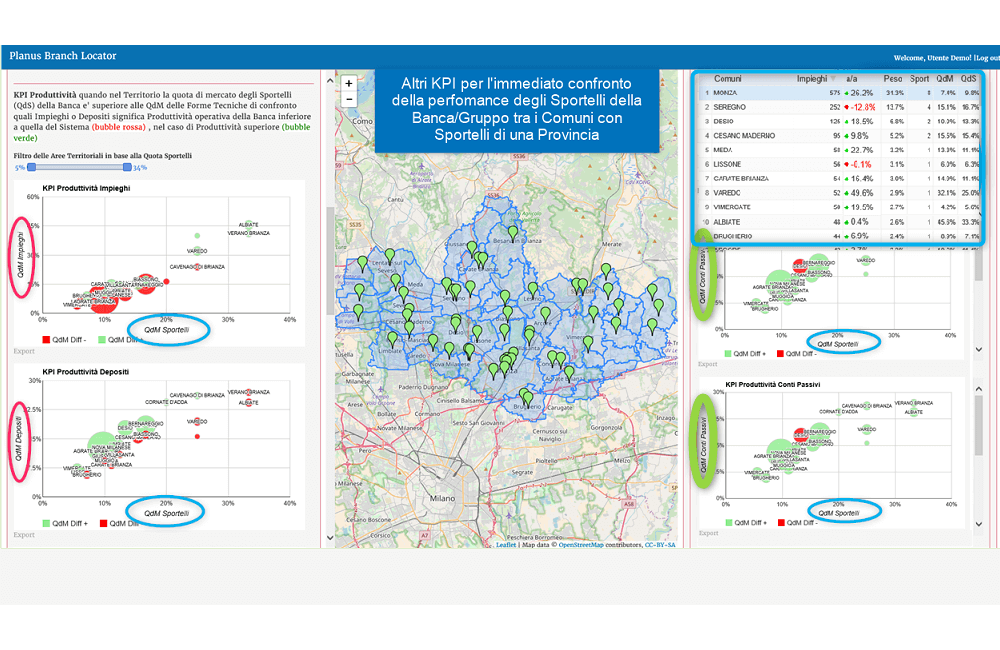

KPI di confronto per Comuni Sportello

Modulo Comuni

Dati di confronto per Comune con presenza di Sportelli

Modulo Comuni

KPI per Comune con presenza di Sportelli

Modulo Comuni

Dati, Metriche e KPI per singolo Sportello nel Comune

Modulo Comuni

Analisi e sintesi per Sportello del Comune

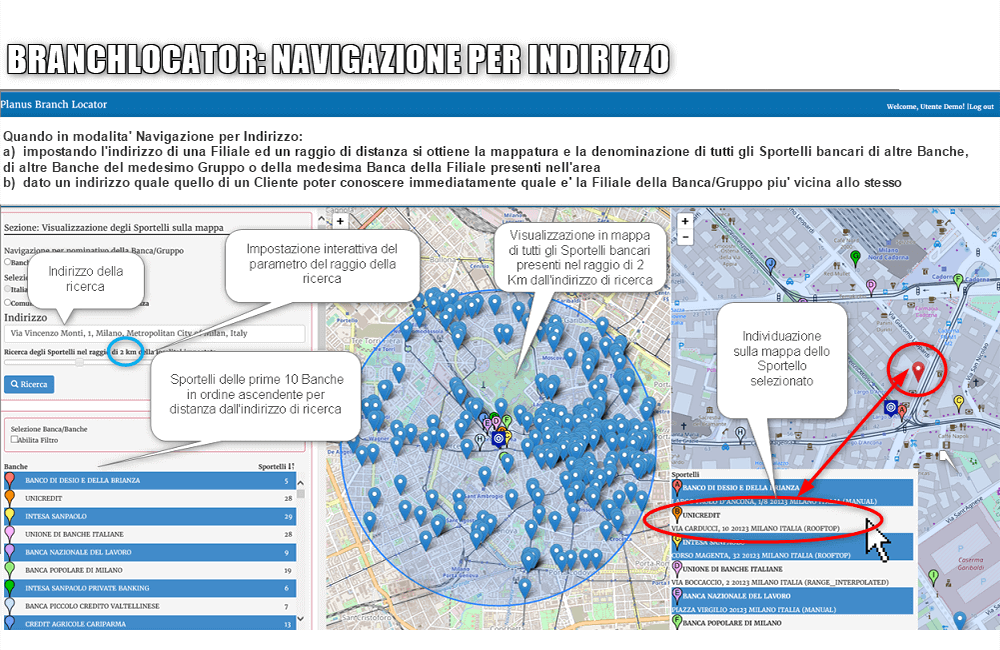

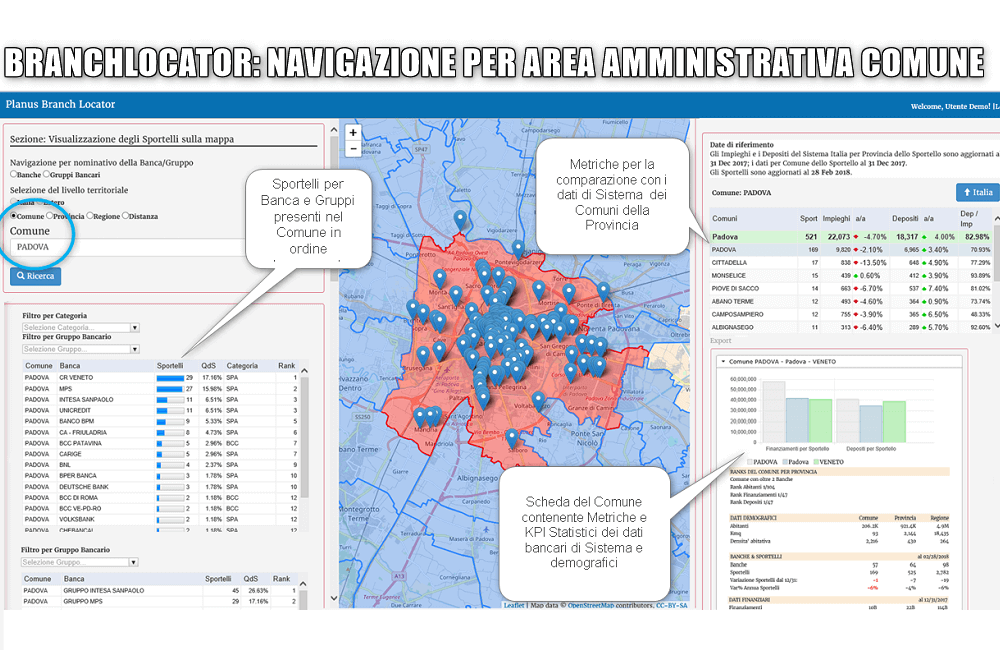

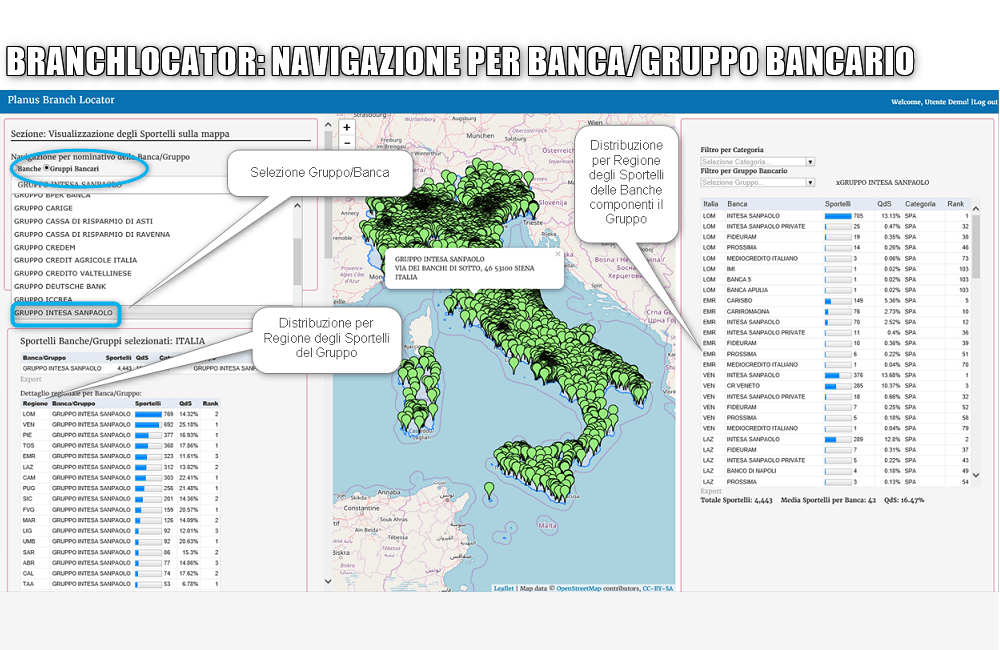

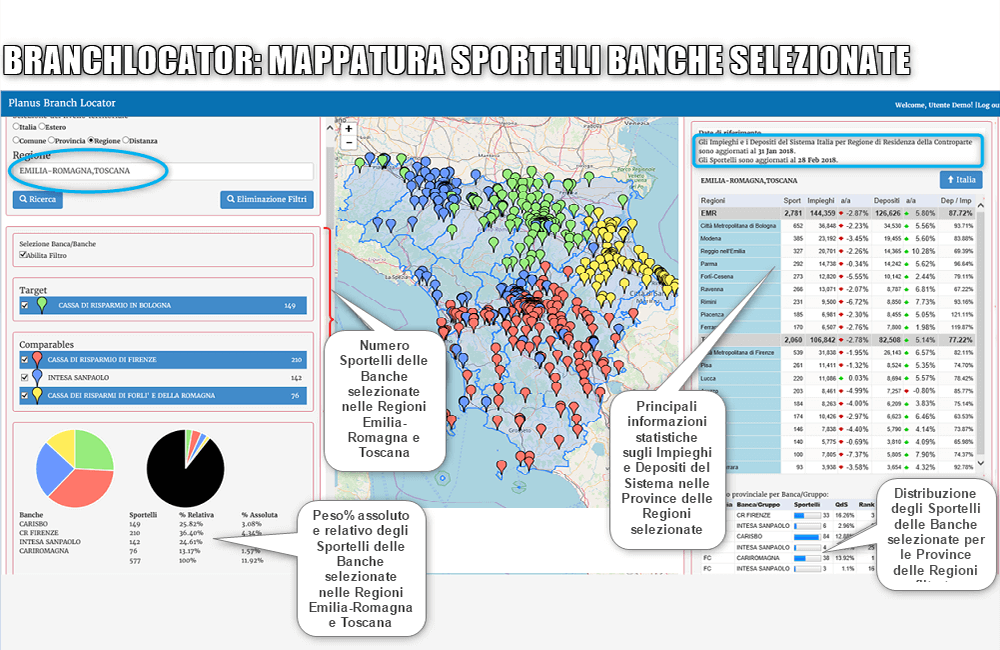

A Geocoding Mapping Tool

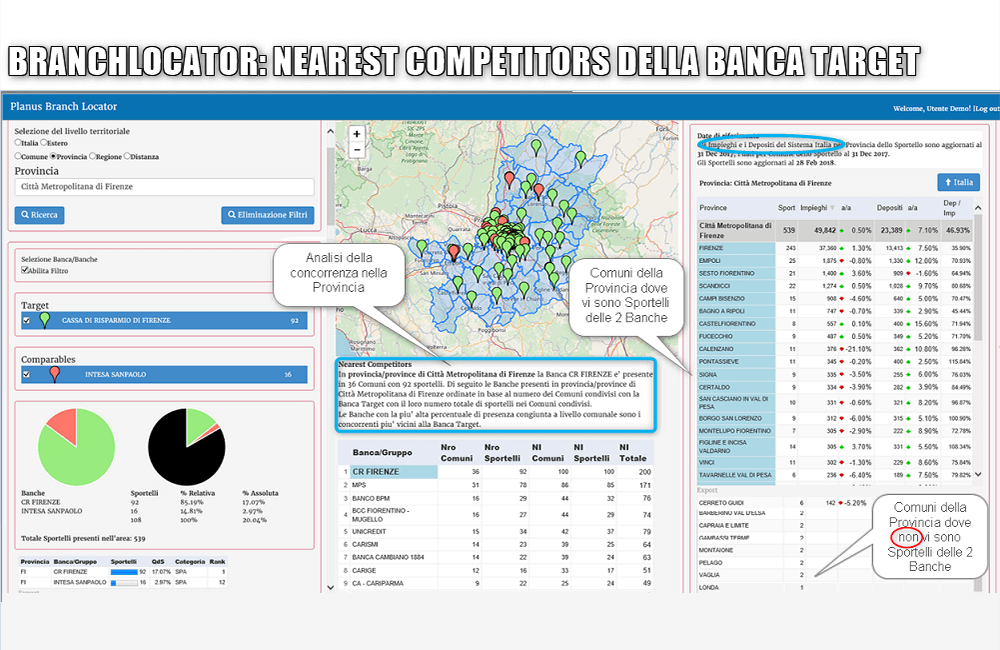

BranchLocator in TerritorioBanca is a GIS tool designed exclusively for the banking industry. The address of every Branch of every Italian bank is geocoded. An advanced search engine provides filtering by Bank/BHC name or geographical criteria (e.g. address, municipality, or region). Based on the filtering path and the selected administrative level the mapped results are enhanced and complemented by indicators and statistical information about the localized Banking industry with the usage of BI algorithms such as “nearest competitors.”

The most popular search criteria are:

- ●Address and distance

- ●Municipality

- ●County

- ●Region

- ●Country

- ●Bank or BHC

Modulo Branch Locator

Navigazione per distanza da un indirizzo

Modulo Branch Locator

Navigazione per Area Amministrativa: Comune

Modulo Branch Locator

Navigazione per nominativa per Banca/Gruppo Bancario

Modulo Branch Locator

Visualizzazione su mappa di un Territorio degli Sportelli delle Banche selezionate

Modulo Branch Locator

Analisi Nearest Competitors della Banca Target

AN INTERACTIVE NAVIGATION TOOL

TerritorioBanca embraces data-centric presentation and its unified data platforms are as accessible to executive management as they are to peripheral analysts. TerritorioBanca provides at-a-glance visuals of performance facilitating both executive-management processes and analysis with specific geographical marketing units. A multi-layered territorial structure provides easy navigation and understanding of KPIs within their physical context. At any step a geographical entity’s statistics (e.g. the county) may be instantly compared with those of similar-level entities (e.g. other counties within the region) or to its higher-level entity (e.g. the region as a whole). Detailed analysis of the measures, indicators, and KPI (if applicable) are provided, as is comparative analysis of the averages of the peer group.

TerritorioBanca manages the profiling and aggregation of information based on each of the Bank/BHC’s internal-marketing territorial divisions. By presenting these statistics in a unified data platform, analytics may be distributed to and used by area marketing managers in exactly the same format as may be used by the Bank/BHC’s Chief Executive Officer.

TerritorioBanca’s analytics platform provides the internal and external resources needed to analyze multi-level indicators and measures and to reveal ranges and distributions within performance results at any relevant geographical level.