BANK COMPARATIVE POSITIONING WITH THE BANK OF ITALY/ECB DATA

Banks and Bank Holding Companies need accurate and timely reports comparing the Bank's performance with the Italian Banking Industry statistics. PlanuSistema was designed to meet this need with a single Database normalizing Bank and the Italian Banking Industry. Dashboards present executives with updated financial industry trends and the impact on internal operations.

Italian Banks are required to file regulatory and statistical reports with the Italian Central Bank and the European Central Bank. Common filings include Matrici di Vigilanza and Finrep. The Bank of Italy processes individual bank regulatory data, aggregates it and in turn distributes monthly to Italian Banks via Flusso di Ritorno Bastra1 data stream. This allows banks standardized information that provides market share and other unique Key Performance Indicators that measure internal Bank strengths and weaknesses.

PlanuSistema is structured and organized into Modules with specific characteristics and objectives:

- Bastra1 core analysis

- Credit oversight

- BDS (Banking Industry public data)

- Banks and Branches

- Credit Risk Agency statistics

- NPL Mortality rate

- Loans and Interest rate reports

- Standardized ECB rate statistics

- 10 day period domestic interest rates

- PivotB1 free form reporting

PlanuSistema Bastra1 provides an easy, well-organized, up-to-date database with Bank/BHC information aligned with the Italian Banking industry’s official statistical reporting.

PlanuSistema Bastra1 currently holds 10 years of historical information and some 4,000 categories of banking products and operations. Its recorded data are constantly updated to respond to the Bank of Italy and ECB supervisory requirements. Depending on the type of Bank/BHC operation, PlanuSistema Bastra1 information can be organized with different dimensional attributes.

Loans/deposits of the Bank/BHC customers can be analyzed geographically from Municipality to International level—wherever the Bank/BHC has branches or customers.

The Bank/BHC’s market trends can be segregated by industry category, NACE classification (e.g. manufacturing, agriculture, real estate), loan-purpose classification (e.g. housing, consumer loan) and/or by overdraft vs. term-loan banking services.

The Bank/BHC credit-risk rating in any geographical area can be monitored and analyzed by current regulatory classifications of loan performance.

At any level of reporting, at-a-glance peer group comparatives allow the Bank/BHC to monitor and analyze:

- ●Market share

- ●Annual, quarterly, and monthly growth rates

- ●Market share of branches

- ●Calculated indicators for measuring the degree of competition in profit and risk

Module Bastra1

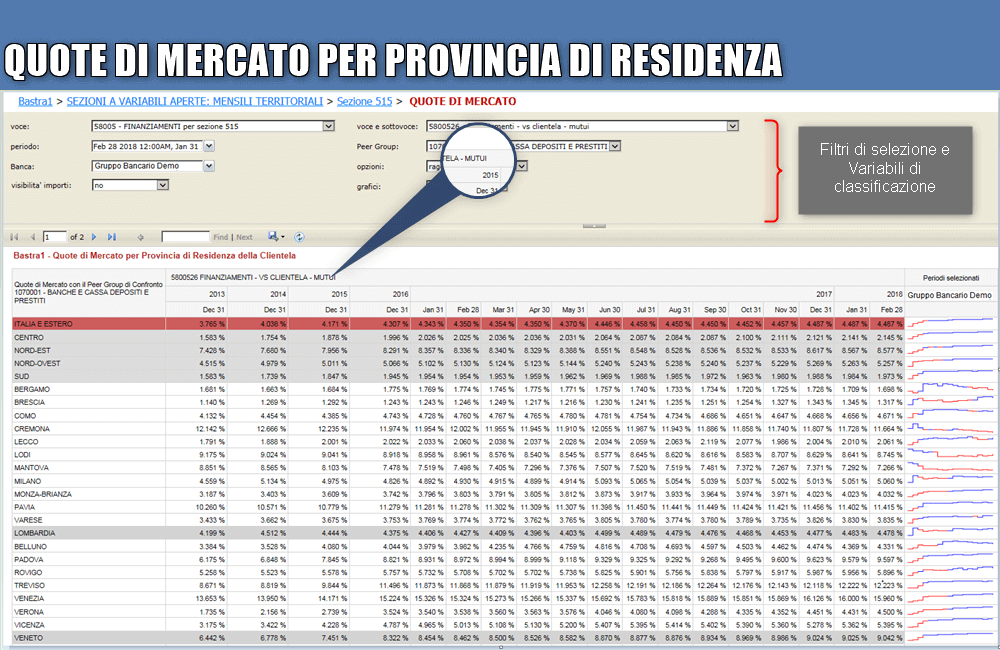

Market share broken down by customer industry and location

Module Bastra1

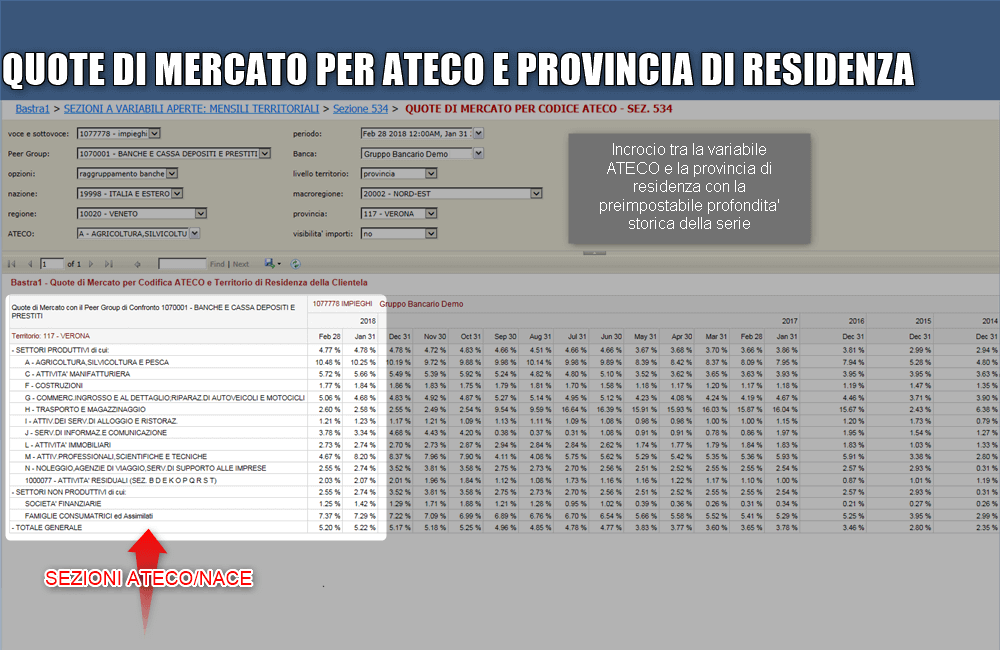

Market share broken down by customer business sector (NACE) and location

Module Bastra1

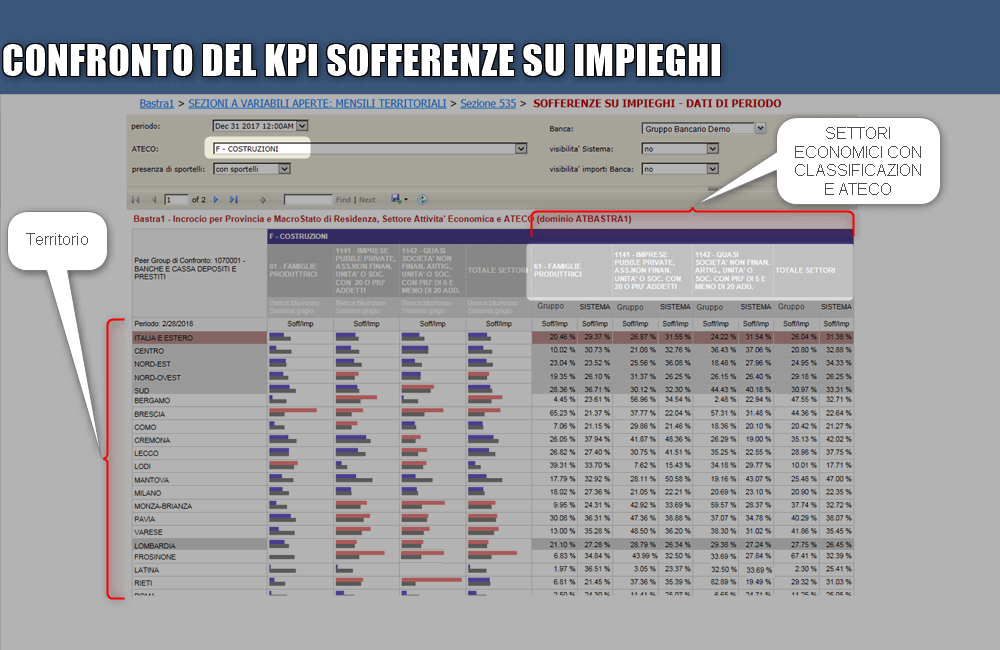

Non-accruing loans divided by total loans broken down by industry, economic sector and location.

Module Bastra1

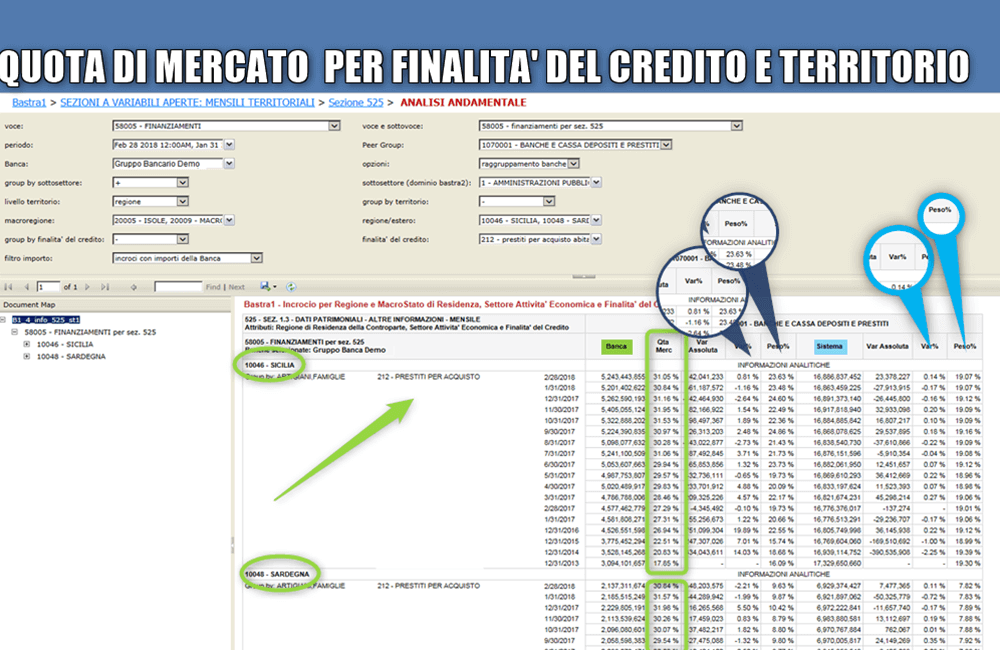

Market share broken down by loan type (housing, car, etc.) and territory

Module Bastra1

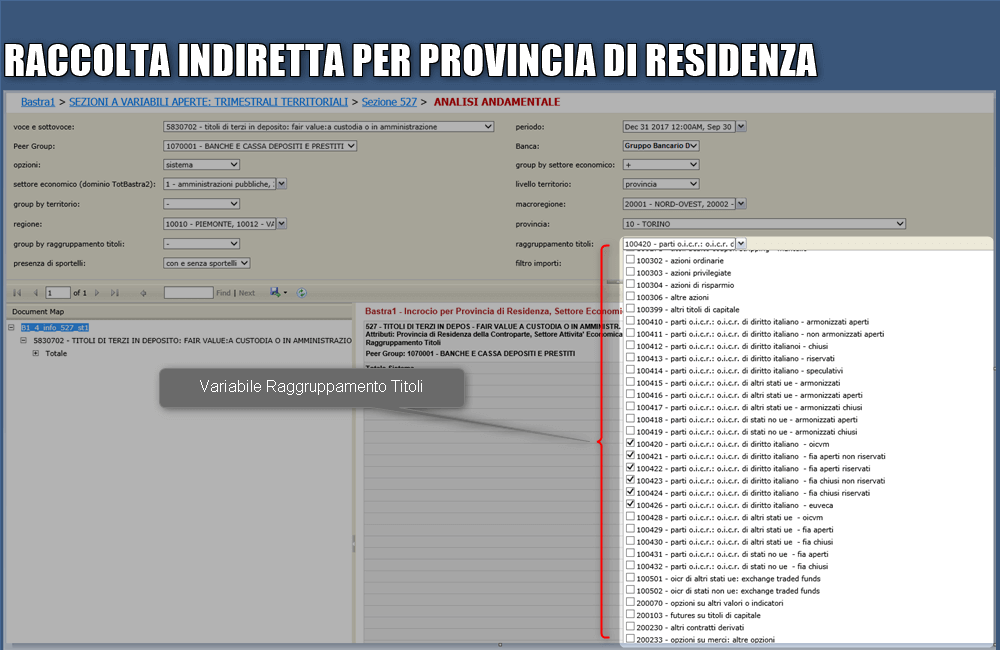

Deposit analysis by customer managed securities by location

Module Bastra1

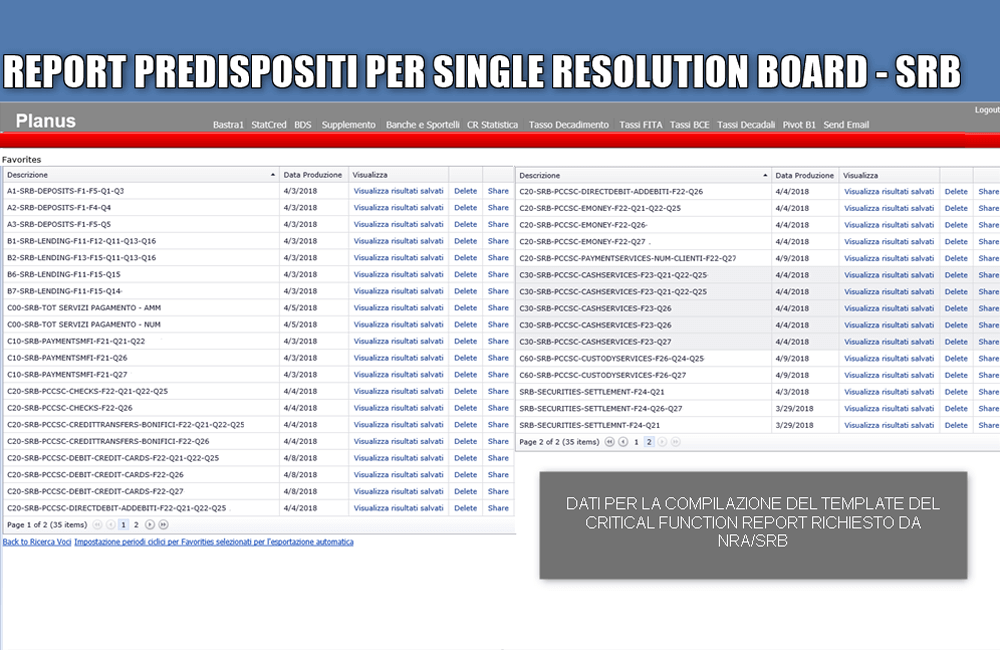

Packaged reports to assist with completing the Critical Functions (BCE/SRB) template

Module Bastra1

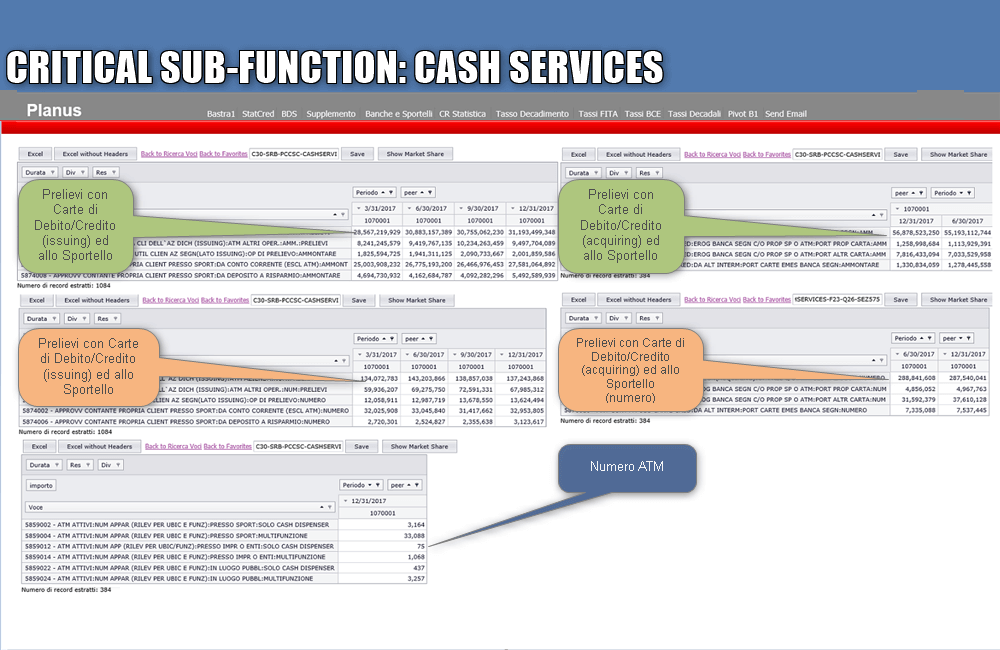

Sample reports used to comply with the Critical Sub-Functions (BCE/SRB) template

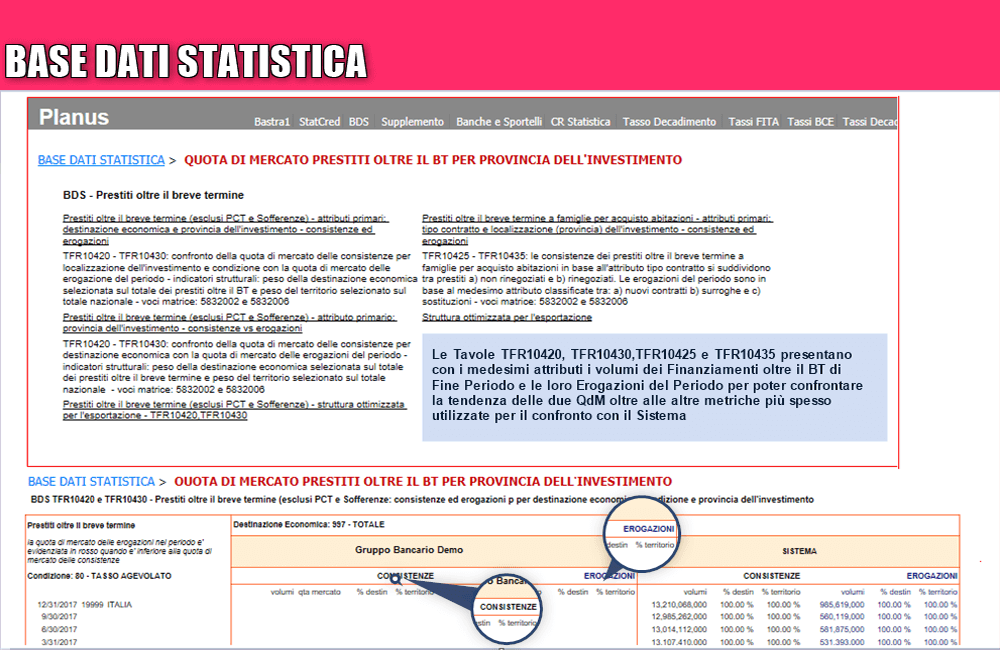

Module BDS

Introduction

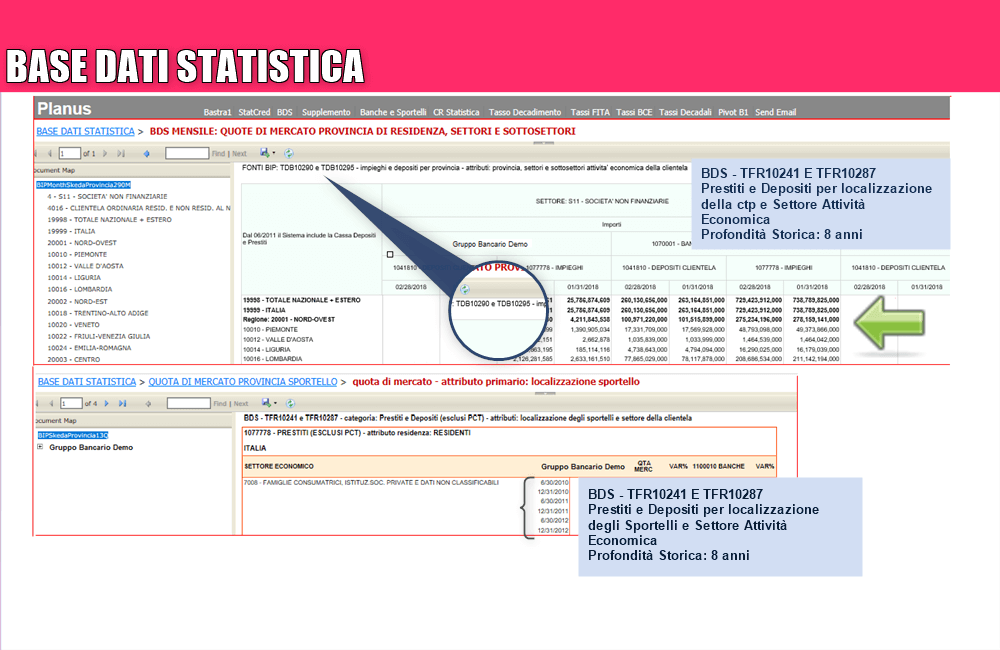

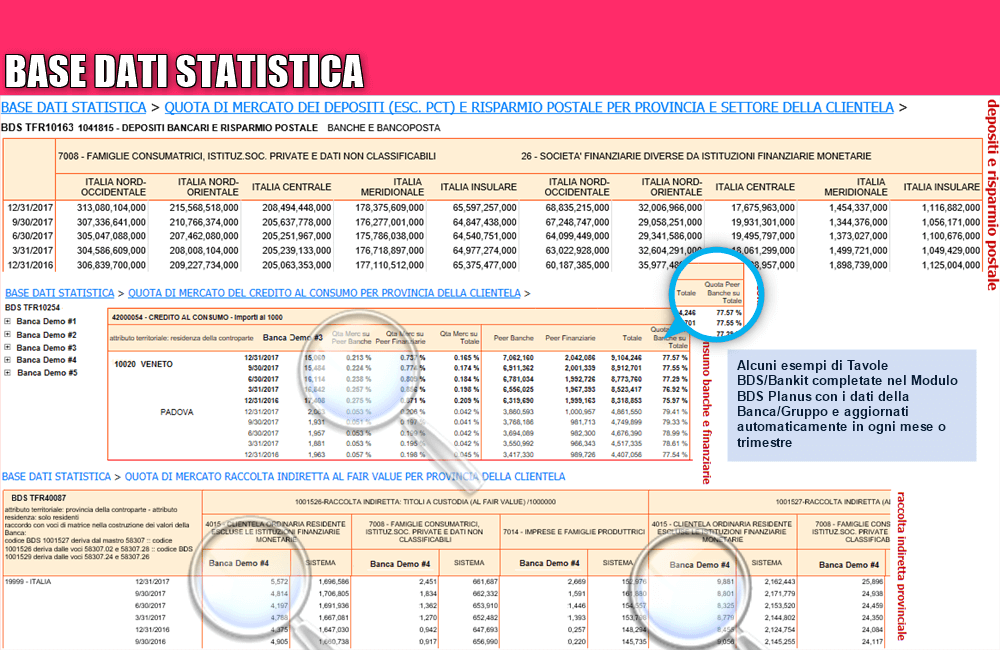

Module BDS

Deposits and Loans by Industry and Location

Module BDS

Long Term Loans

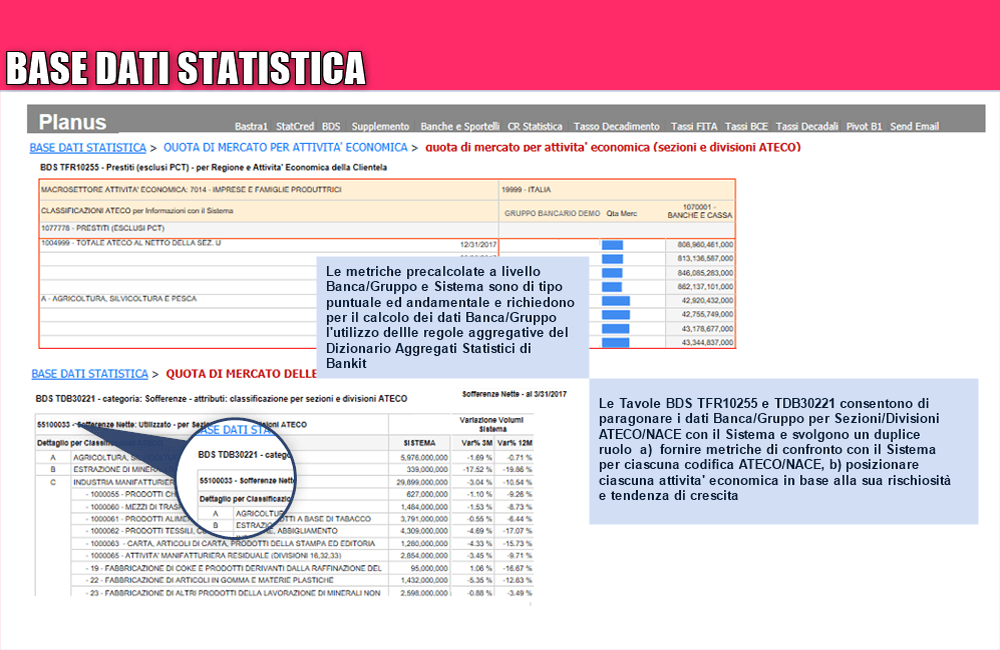

Module BDS

Market Share by Economic Sector (NACE)

Module BDS

Comparing Post Office Savings Accounts, Consumer Loans and Asset Mangement

PlanuSistema BDS is an online database designed and published by the Bank of Italy to provide the most recent monthly and historical key data with regard to relevant statistical information reported by all Italian banks. This data supplements the statistics analyzed in PlanuSistema Bastra1 by considering banking industry operations from different perspectives or by providing analysis with different levels of aggregation in variable or peer group definitions.

Within PlanuSistema BDS the reported data are enhanced with interest-rate statistics, payment-system trends, or credit-risk concentration analysis.

PlanuSistema BDS provides a management tool that compares the Bank/BHC loans, deposits, NPLs, and asset-management services with specific peer group summarized data. The comparisons are analyzed by calculating measures, indicators, and trends such as:

- ●Market share by customer county of residence and industry

- ●Market share by branch county

- ●Market share by investment county

- ●Market share by borrower NACE

- ●Market share of postal savings

- ●Market share of consumer loans

- ●Market share of customer asset management services

- ●Credit risk/quality analysis at geographical, industry, or NACE level

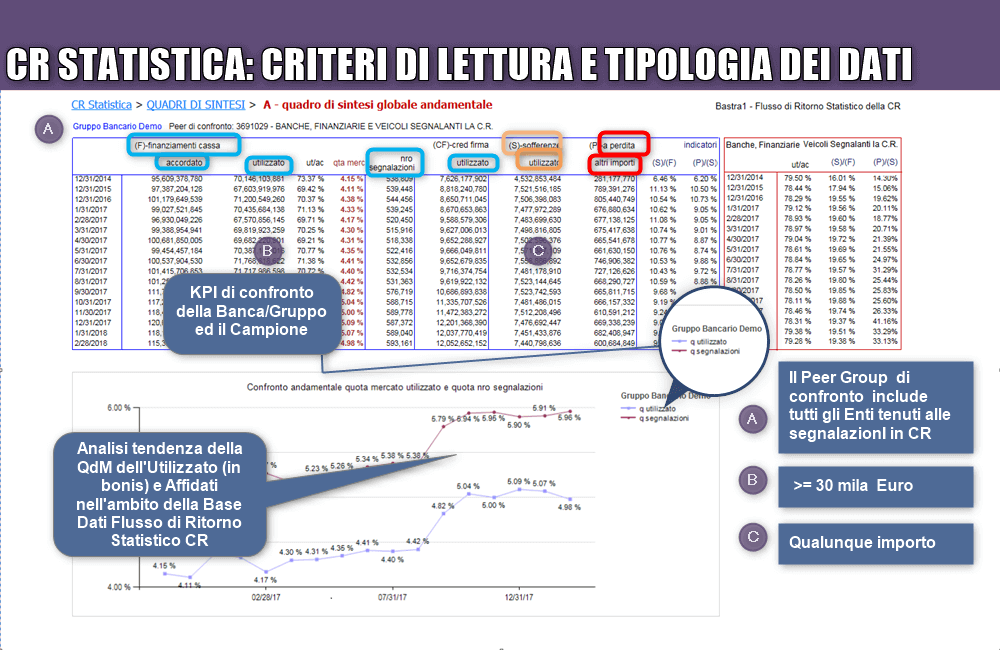

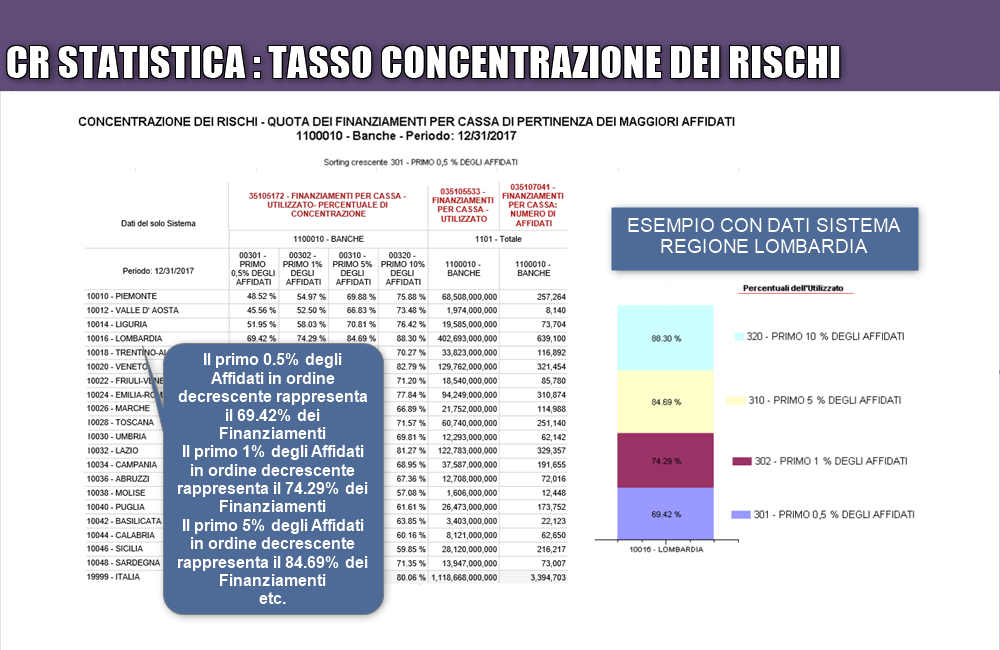

The Bank of Italy provides a monthly uniform aggregated statistical report (Flusso di Ritorno CR Statistico) of all loans extended by the Italian financial-services industry to borrowers with an overall exposure higher than a pre-set threshold (currently €30,000).

This report is available to all Italian Bank/BHCs and includes all non-interest-accruing loans and write-offs regardless of their amount.

The primary objective of the report is to provide the Italian financial-services industry with an effective credit-risk management tool using up-to-date information of a) market trends by industry sector, NACE and geographical location of both borrowers and Bank/BHC branches, and b) the credit quality of the markets by the same levels of analysis.

CR Statistica allows for the comparison of Bank/BHC data in any sector and product category within the Bank of Italy report by precalculating key indicators as well as enabling users to download the information as row data for internal analysis.

Main menu items include:

- ●At-a-glance summaries of historical trends

- ●Loans by risk categories (e.g. short- vs. long-term)

- ●NPLs

- ●Securitized assets

- ●Credit collateral and standby letters of credit

- ●Financial derivatives

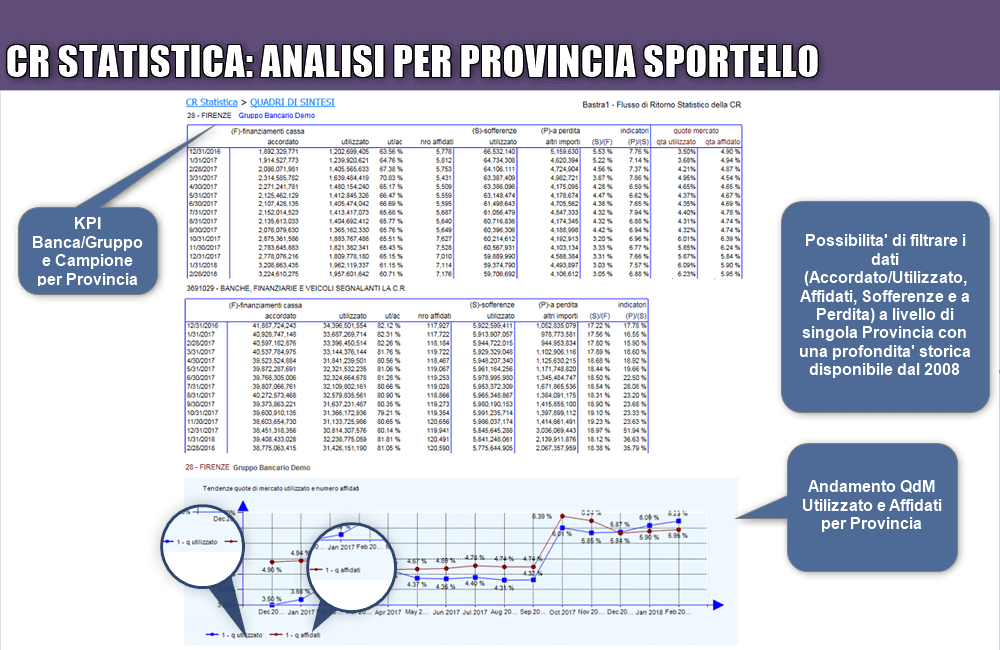

Modulo CR Statistica

Summary Report

Modulo CR Statistica

Market Share by County Branch

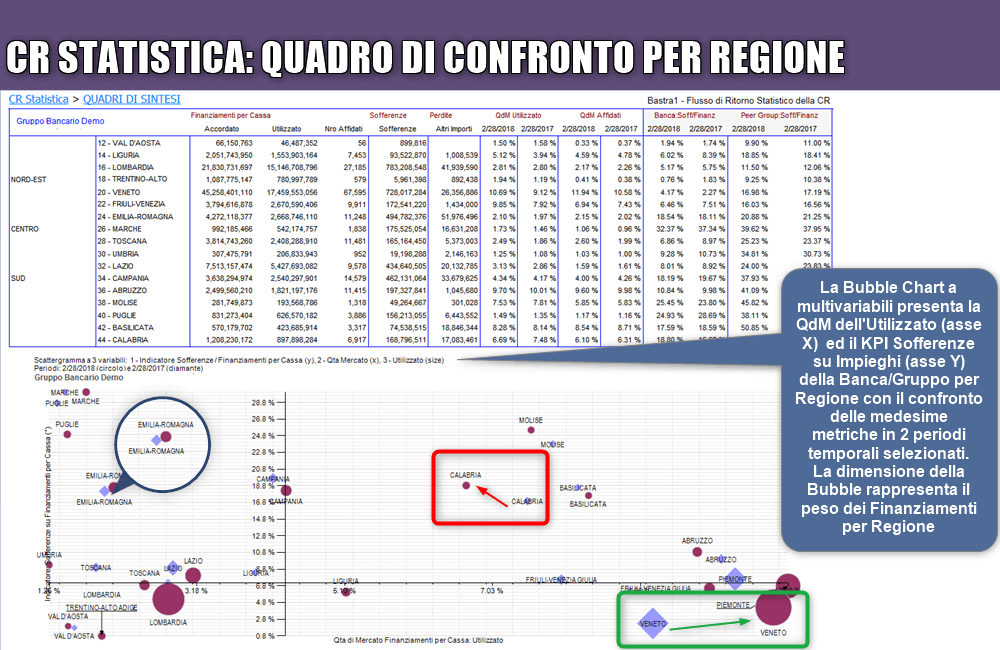

Modulo CR Statistica

Scattergram Chart by Branch Region

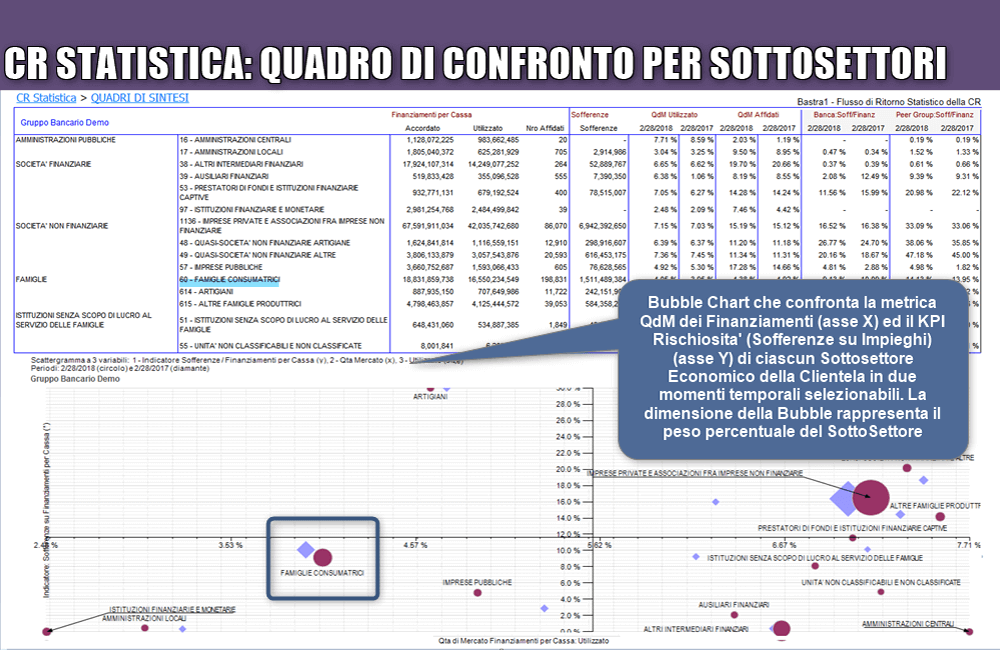

Modulo CR Statistica

Industry Sub-Sector Scattergram Chart

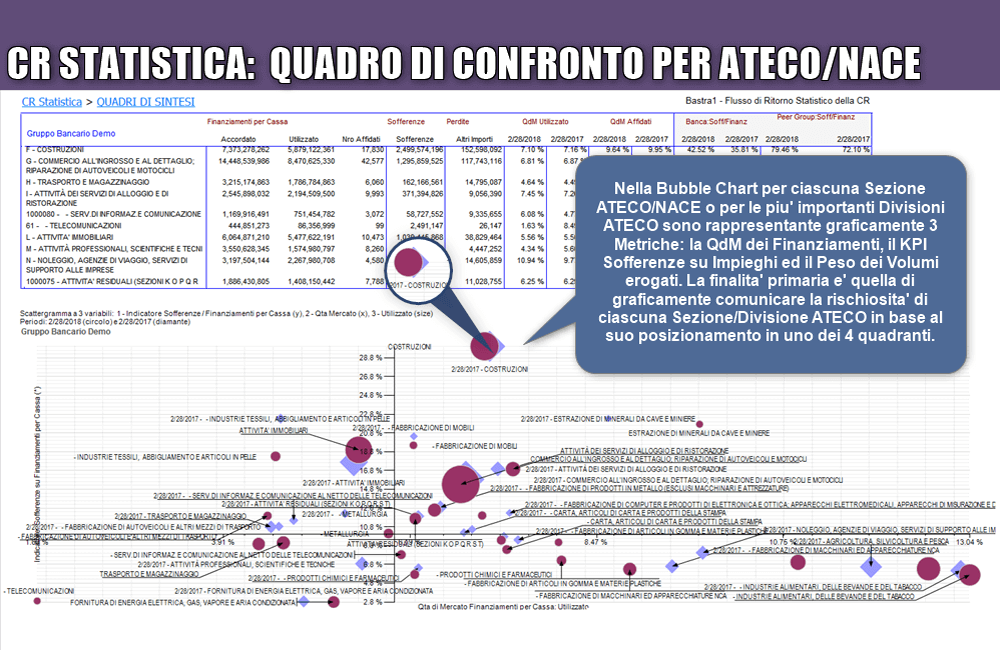

Modulo CR Statistica

Scattergram Chart by NACE Division

Modulo CR Statistica

Analysis of Risk Concentration

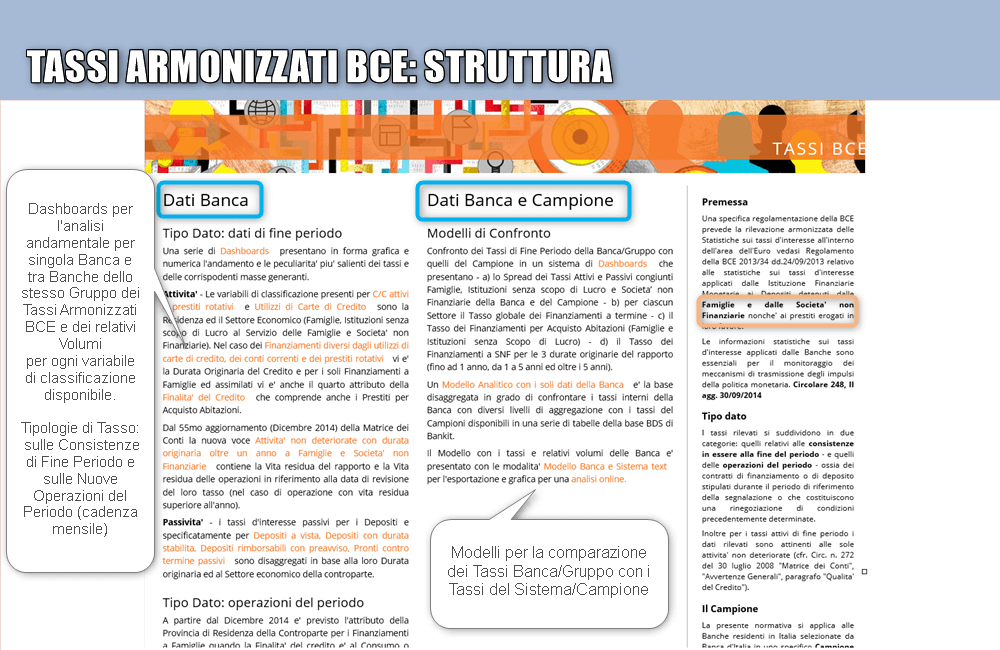

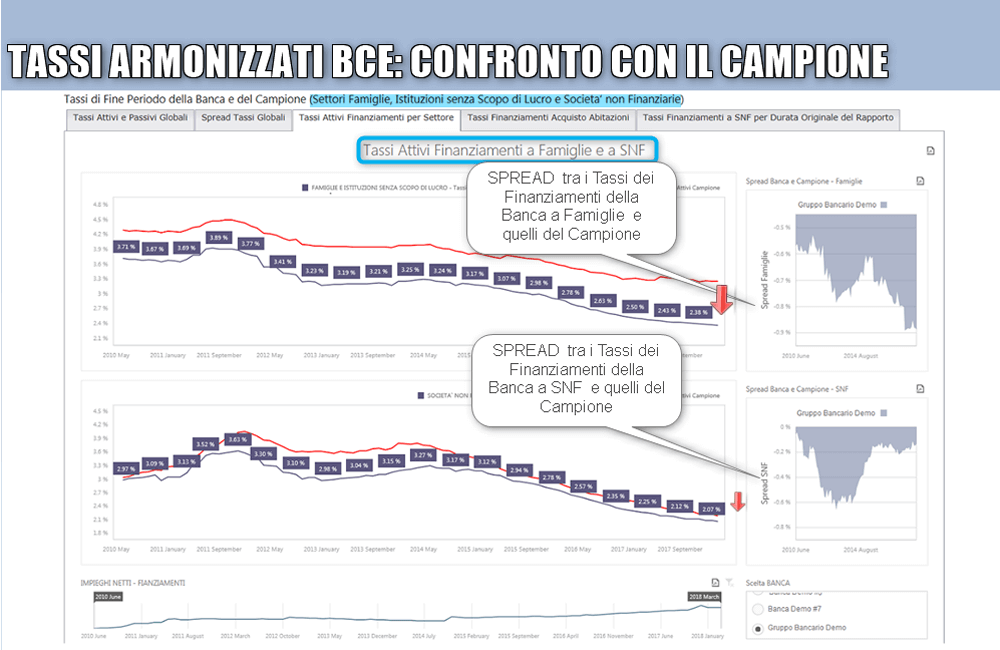

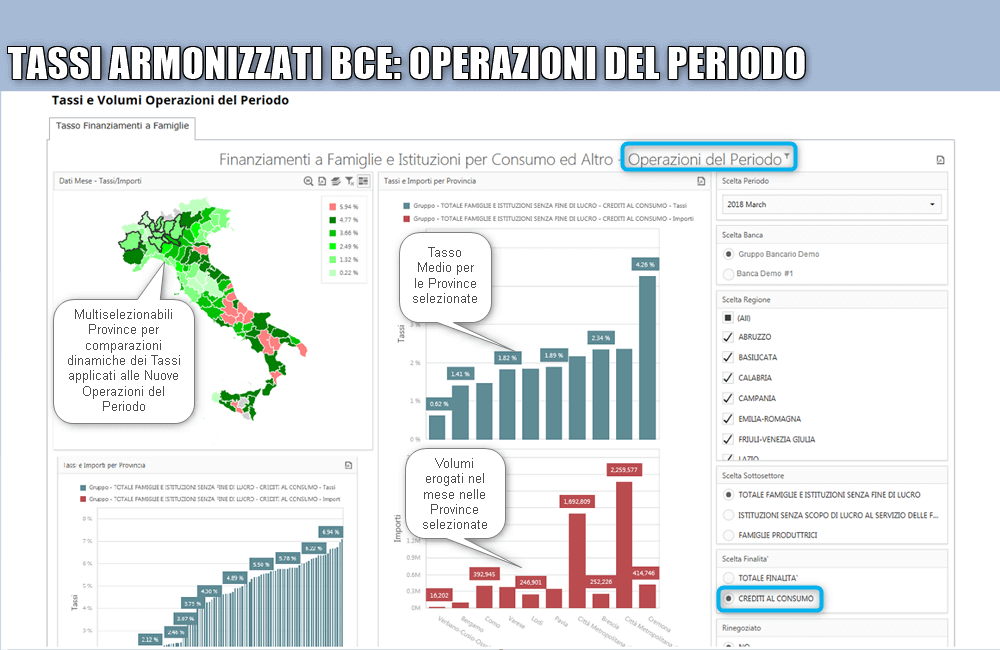

Modulo Tassi BCE

Introduction

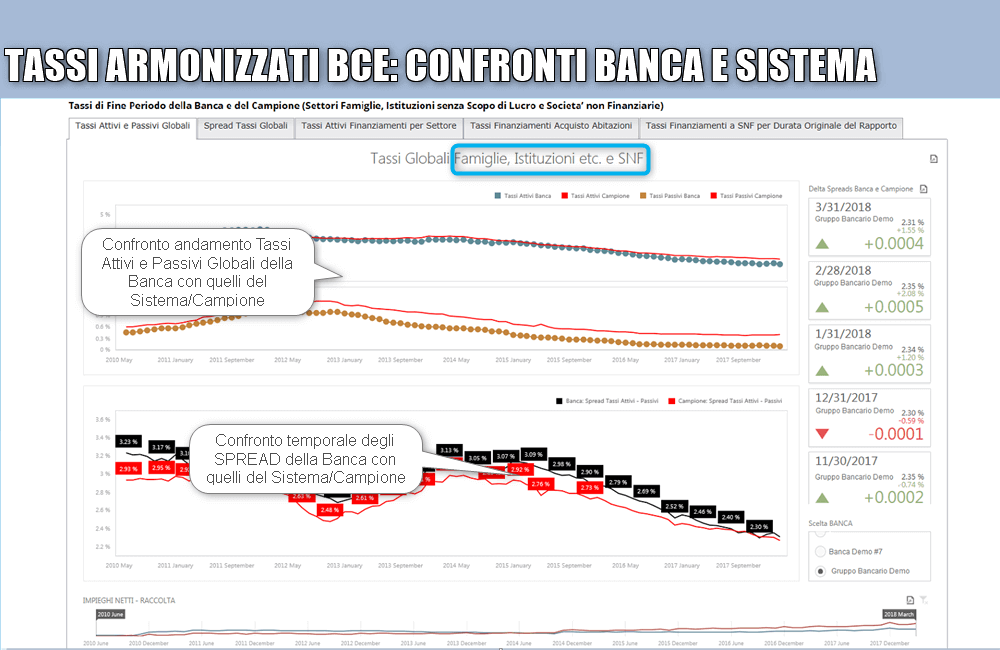

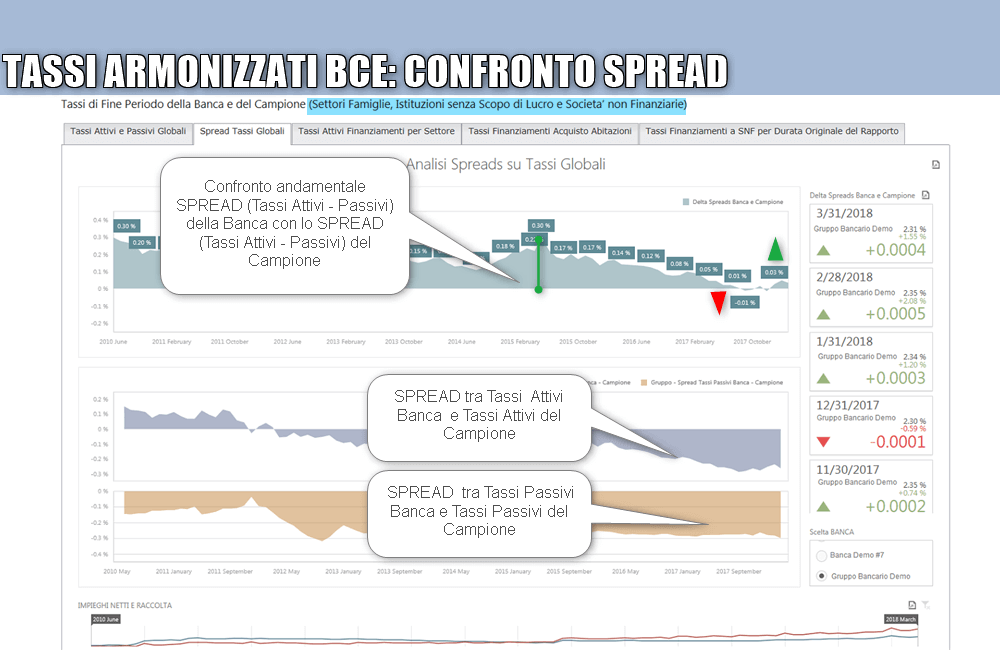

Modulo Tassi BCE

Dashboard of Interest Rates and Spreads

Modulo Tassi BCE

Historical Trend of Spreads by Industry

Modulo Tassi BCE

Historical Trends of Interest Rates Spreads by NFS and Households

Modulo Tassi BCE

Interactive Map of New Consumer Loans

The uniform ECB (European Central Bank) Harmonised Interest Rate statistical report, published monthly in the BDS advanced reporting section, provides an up-to-date outlook of loan and deposit interest rates for consumers and non-financial corporations (NFC). The report deals separately with a) average interest rates and volumes of new business and b) average interest rates and outstanding volumes at the end of period.

By using the same aggregation criteria as the Bank of Italy, PlanuSistema BCE provides the Bank/BHC with an up-to-date online tool with which to measure a) the difference between the Bank/BHC’s interest rates and the market rates on new business, b) new-business market share growth trend, and c) the average interest-rate spread on outstanding volumes.

A series of online Dashboards deal with:

- ●Interest-rate spreads within the system

- ●Interest rates by type of loan, class of amount, and industry

- ●Interest rates by loan purpose (housing, consumer, other)

- ●Interest rate to NFC by type of loan, IRF, and collateral

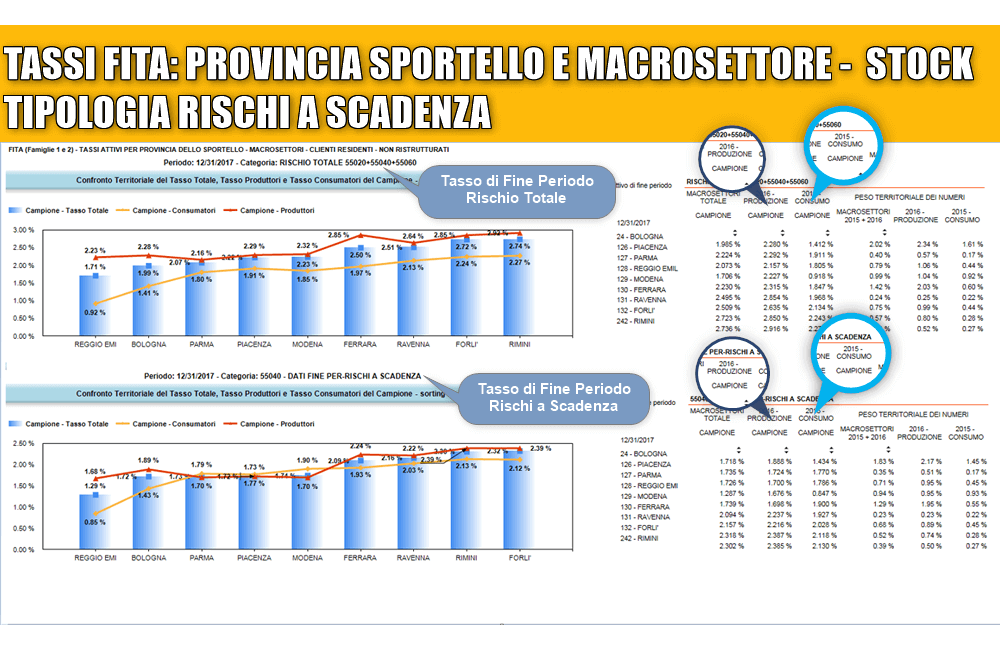

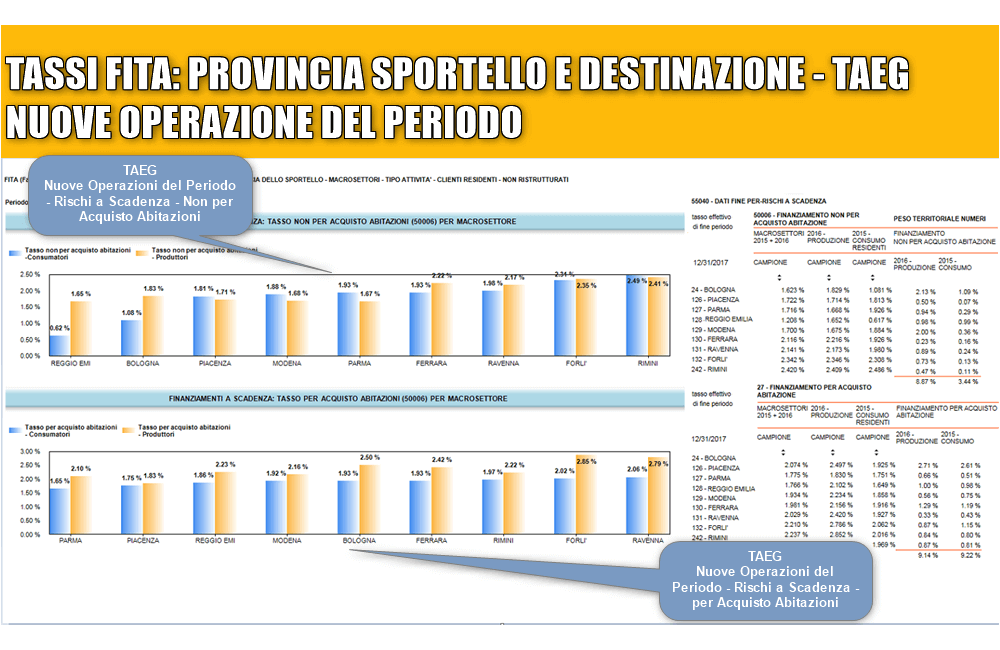

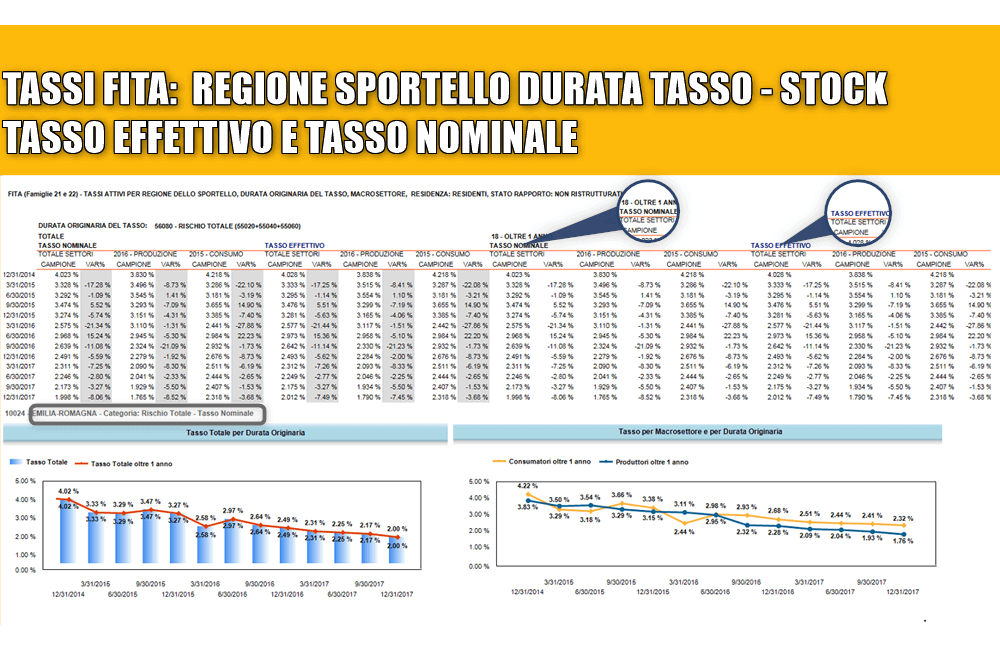

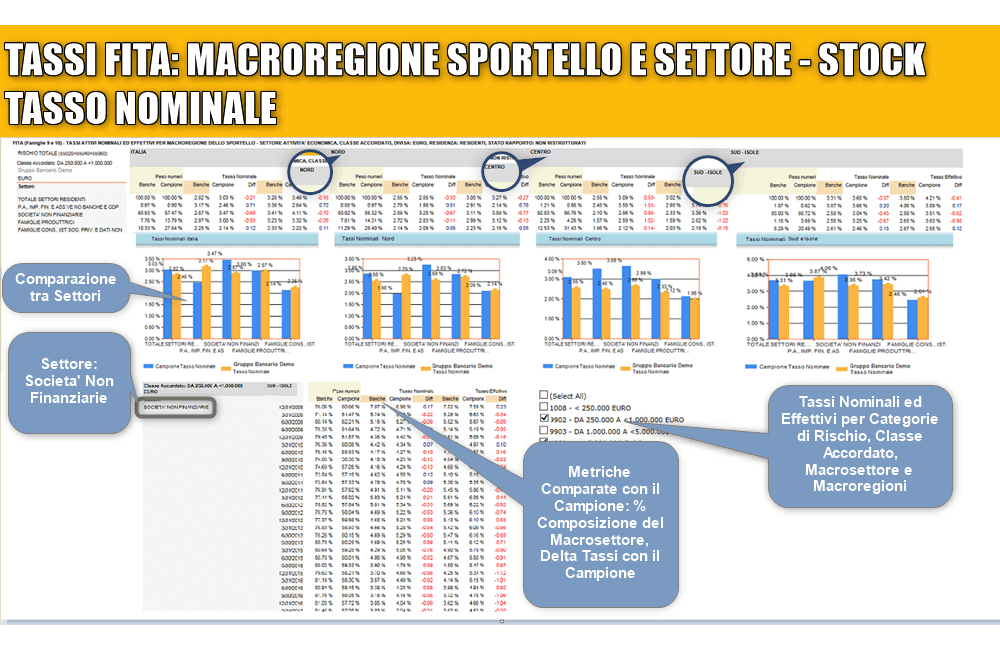

The Bank of Italy provides a quarterly uniform statistical report (Tassi FITA) dealing specifically with loan interest rates by products, customer industry, customer NACE, and branch location. This report is available to all Italian Bank/BHCs and is currently the only available report providing interest-rate loan analysis by location at Italian County level.

In the case of mortgage loans the available data are a) end-of-period average interest rate (APR), b) previous-quarter new-business average annual interest rate (APR), and c) previous-quarter new-business average annual interest rate of charge (APRC).

PlanuSistema FITA provides the Bank/BHC with a normalized database with which to respond to key analytical requirements according to nominal, effective, and APRC rate spreads within the Italian financial-services market at any available level of detail.

Interest rates are arranged by category:

- ●Loan term

- ●Initial rate fixation

- ●Location (County, Region, MacroRegion, State)

- ●Economic industry

- ●Economic activity NACE

- ●Loan terms

- ●Loan amount class

Modulo Tassi FITA

Loan Interest Rates by County Branch

Modulo Tassi FITA

APRS Rates of Housing Mortgage Loans by County Branch

Modulo Tassi FITA

Annualized Agreed Rate vs. Narrowly Defined Effective Rate per Branch Region

Modulo Tassi FITA

Annualized Agreed Rate by Branch Macro Region, Industry and Loan Amount

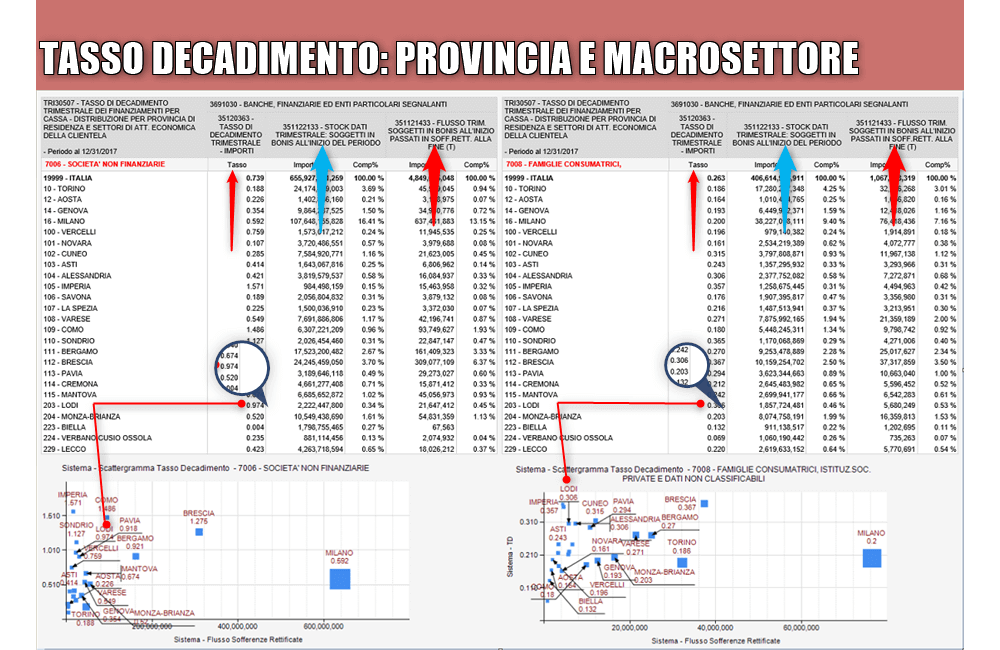

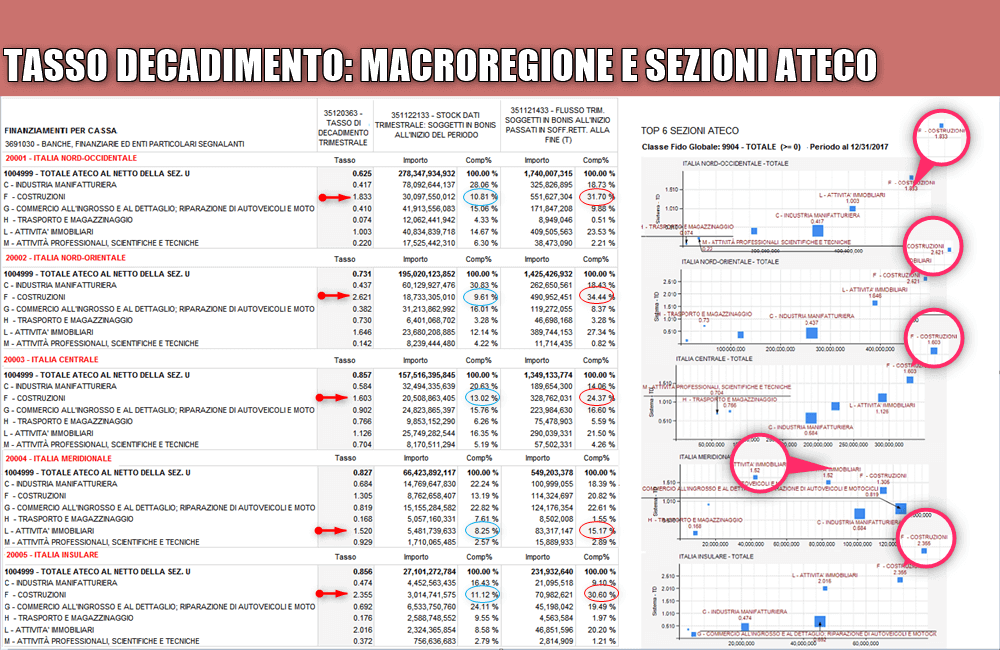

Modulo Tasso Decadimento Finanziamenti

Scattergram Chart of Mortality Rate by County and Macro Industry

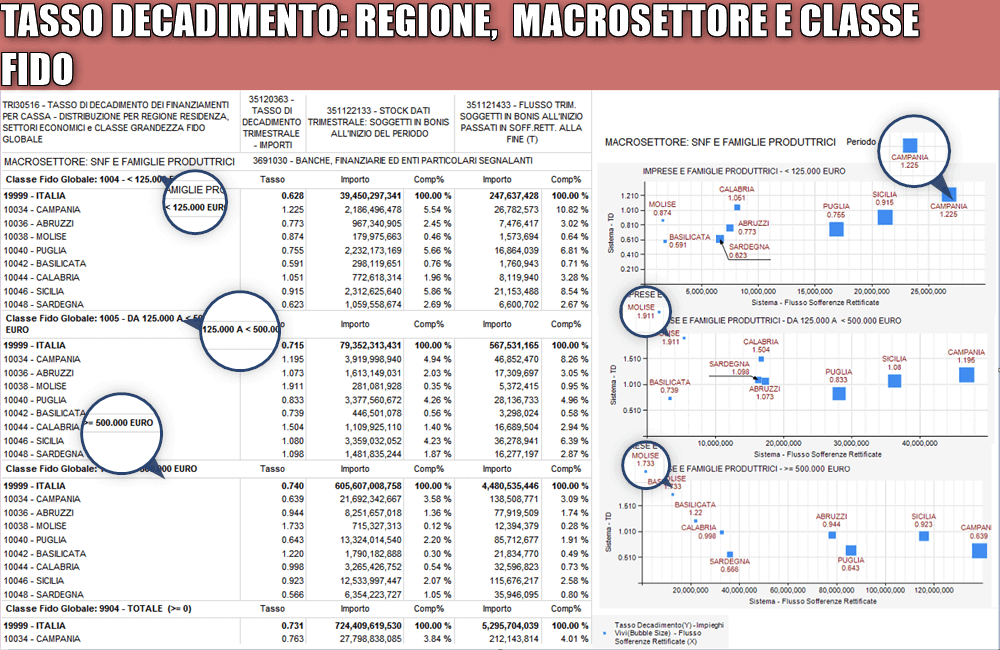

Modulo Tasso Decadimento Finanziamenti

Scattergram Chart of Mortality Rate by Region, Industry and Loan Approved Amount

Modulo Tasso Decadimento Finanziamenti

Scattergarm Chart of Mortality Rate by Economic Sector (NACE) and Macro Region

The Bank of Italy provides a quarterly uniform statistical report (Tasso di Decadimento) providing key measures of loan mortality rate within the Italian banking industry by customer location, customer industry and economic activity and other factors. The mortality rate is calculated by either number of cases (units) or amounts of loans that have migrated over a certain period of time (quarter or year) from performing-loan status to default-loan status. The indicator is calculated by dividing the units/amounts that have changed status by the units/amounts that were in good standing in the previous equivalent time period.

PlanuSistema TD uses the attributes of the Bank of Italy report and calculates the equivalent Bank/BHC key indicator. This provides the Bank/BHC with a credit-risk model based on the ratings of the underlying portafolio, and sets uniform criteria in:

- ●providing the Bank/BHC's credit-risk quality assessment in respect to the market at different levels

- ●applying more sophisticated criteria in the definition of NPLs